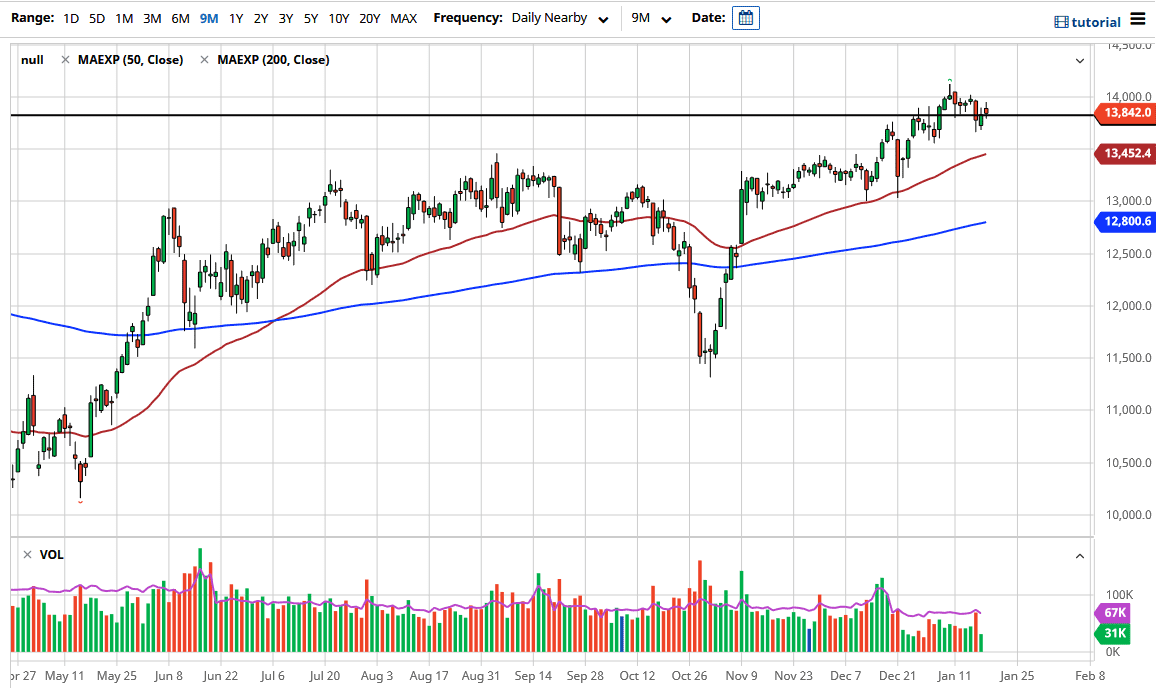

Even though the ZEW numbers for the month were better than anticipated, the reality is that the DAX Index was somewhat choppy during the trading session on Tuesday. Perhaps the German trading public is feeling a little bit over-stretched at the moment, as we recently tested the 14,000 level. That is a large, round, psychologically significant figure, and as a result, it makes sense that we may need to go sideways in the short term in order to build up enough momentum to go towards the 15,000 level.

To the downside, the 50-day EMA offers plenty of support near the 13,500 level underneath, so we may see a bit of buying pressure if we get down to that area. I do not think that the market is going to break down below it anytime soon, though; but if it did, then it could open up a move down to the 13,000 handle, possibly even down to the 200-day EMA underneath there. Nonetheless, this is a market that continues to go higher based upon the overall reflation trade, which can favor Germany in general, as it is a major exporter of large industrial components. The DAX is considered to be the “blue-chip stock index” for the European Union. This is the first place people go to, and in a sense, it quite often will act very much like the Dow Jones Industrial Average in America, as it favors so much in the way of industry.

The euro could continue to see a lot of choppy and volatile trading, and that could continue to cause issues for the DAX in and of itself. After all, if the euro gets to be a bit too expensive, then it could cause a certain amount of trouble for the DAX, as it makes those German exports so much more expensive. The DAX is almost entirely based upon exports, at least from the 20,000 foot level view. The market is likely to see a lot of choppiness around this area, but I do think that we are trying to build up a case for a move higher based upon the idea that the vaccine will make everything great again worldwide, and therefore drive up massive amounts of demand.