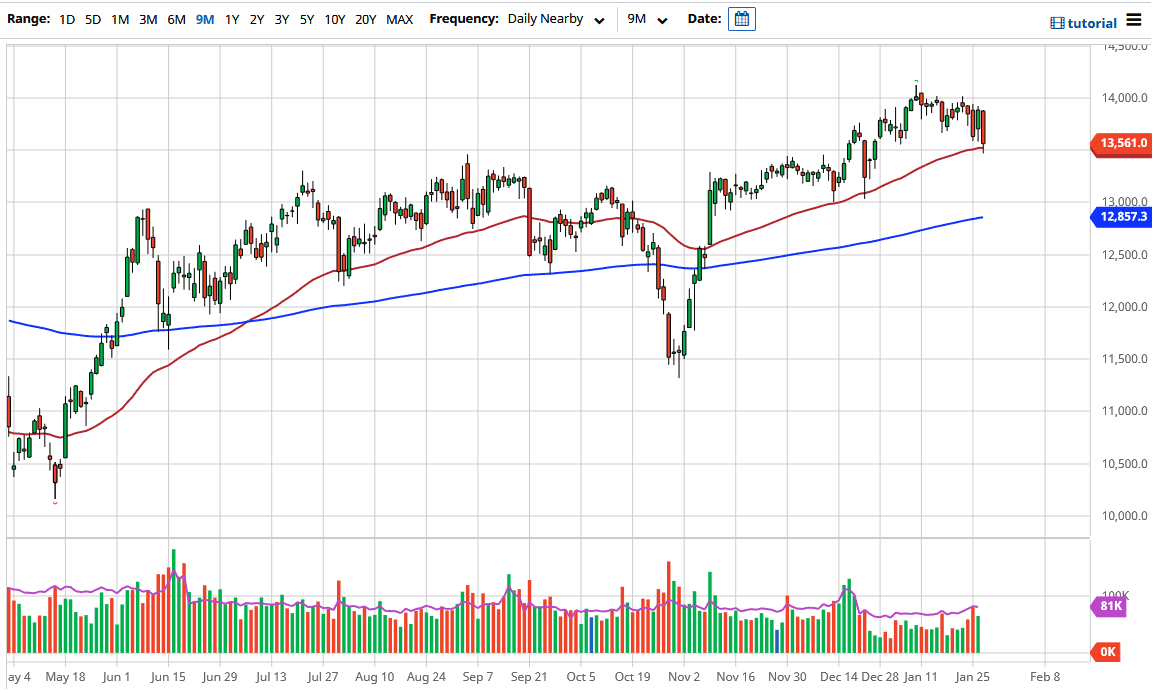

The German index has struggled a bit during the trading session here on Wednesday to reach down towards the 50 day EMA. The 50 day EMA of course is a major technical indicator that a lot of longer-term traders pay attention to. The 13,500 level also sits right there, so it does make quite a bit of sense that we would see a little bit of support there as well. After all, it was previous resistance so there is a certain bit of market memory that comes into play.

Stock markets across the world got hit during the day so it is not a huge surprise that we would see Germany follow right along. The size of the candlestick of course is somewhat impressive, and it does suggest that perhaps we could see a little bit of follow-through. I believe this is a short-term pullback more than anything else though, because we continue to see a lot of concern about the coronavirus lockdown, and therefore people are starting to worry about whether or not the economy is ever going to continue to recover based upon the infections. Coronavirus vaccinations are slowing down in the European Union as supply is struggling, and that might be part of what we are seeing here.

The 14,000 level has offered significant resistance, but I do think that eventually we will go back to test that area again. When you look at the overall attitude of the market, we are still very positive despite the fact that we have seen quite a bit of selling. I think given enough time we will continue to see more of a “buy on the dips” type of scenario, but that does not mean that is going to be easy to hang onto bullish positions. Because of this I would be very cautious about jumping in with both feet, and I think that we more than likely we will have to find some type of stability in order to get remotely aggressive to the upside. I would clearly not be a seller though, because the markets have been in an uptrend and over the longer term it appears that the value hunters continue to come back time and time again and therefore I do believe that eventually we will eventually push the DAX towards the 15,000 level.