The German Business Climate Index numbers came out during the trading session on Monday, a bit lighter than anticipated. The market is likely to continue to see real concern about the European Union going forward, which by extension has a direct effect on Germany, its most important economy. If we continue to see a lack of confidence in Germany by small business owners, that is very likely due to the fact that the coronavirus lockdowns have extended. Obviously, if the economy is locked down that is absolutely toxic to growth. The question is whether or not the ECB will ride to the rescue.

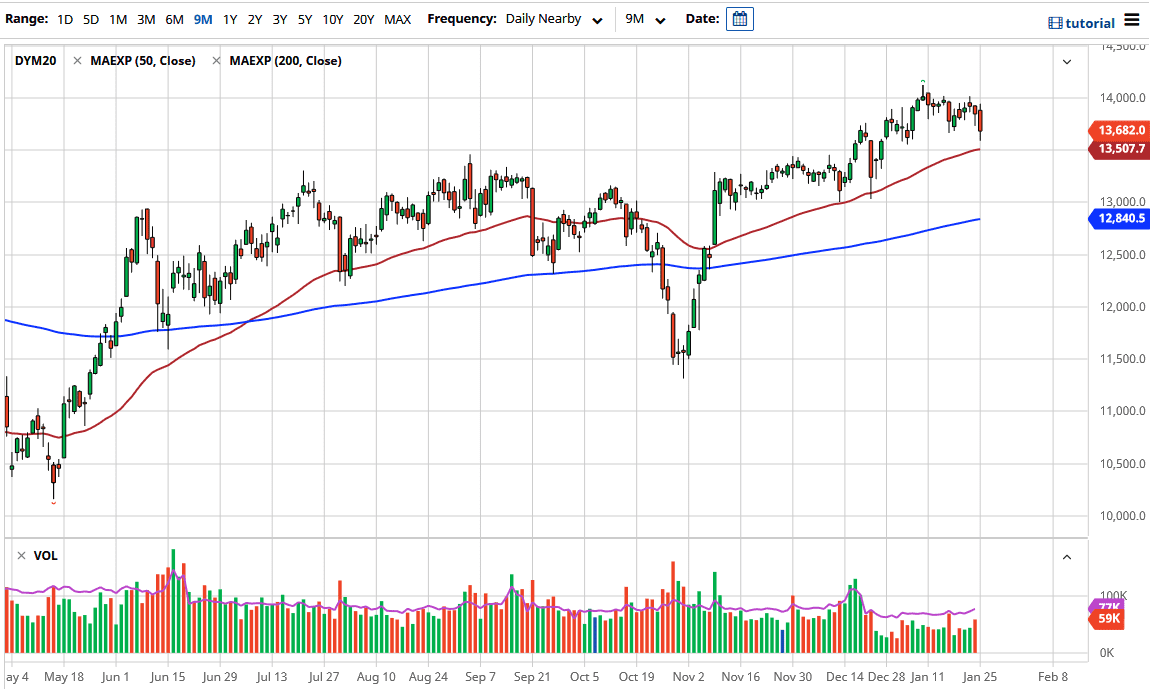

The 50-day EMA is sitting at the 13,500 level, and now offers quite a bit of support. The area previously had been resistance, which at this point now has a certain amount of “market memory”. We will continue to look at dips as potential buying opportunities, because the German economy is one of the first places people go to look for strength in the European Union. It is considered to be the “blue-chip stock index”, so the DAX will serve that function.

The reflation trade around the world should continue to see a lot of money be moved towards it, and that favors massive exports coming out of Germany as it is a heavy industrial exporter. This is a market that continues to reach towards the 15,000 level to the upside, but that does not mean that we will get there very easily, nor right away. To the downside, the 13,000 level is a large, round, psychologically significant figure, and an area that should offer quite a bit of support based upon structure and possibly even the 200-day EMA popping into the area will only solidify that as well. This is a market that I have no interest in shorting, at least not until we break down below the 13,000 level and perhaps even further. It is simply easier to buy the dips in most indices when it comes to developed nations.