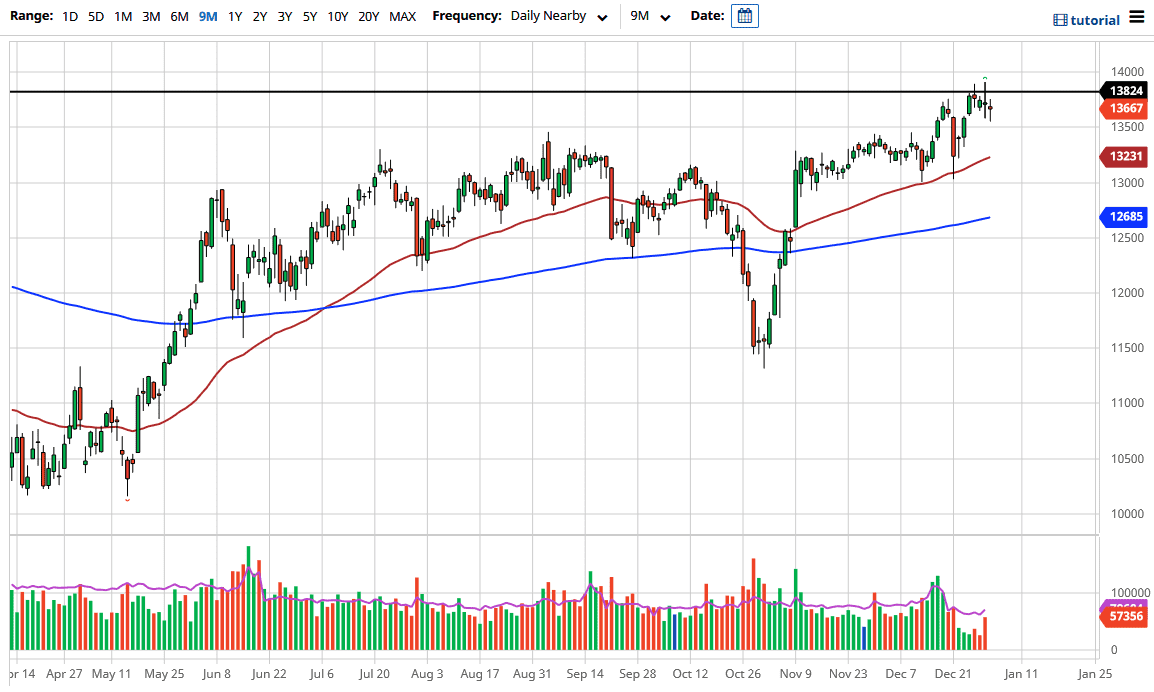

The DAX Index fluctuated in rather choppy trading on Tuesday, which looks a lot like what we had seen during the day on Monday. This is a market that should find buyers underneath, though, because we have been in a nice uptrend for some time. The 13,500 level is an area that previously had been resistance, and now could offer a bit of support, although it is worth noting that we had broken through it before. The 50-day EMA underneath should continue to go higher, and the market will likely continue to pay attention to it as well. Beyond that, the 13,000 level also looks very interesting as previous support as well.

One of the things to pay attention to is the euro, and how it behaves in the Forex markets. Keep in mind that Germany is a major exporting nation, so the cost of its currency is going to be a major problem. It currently looks as if the Euro is trying to break above the 1.23 level, and if we can break above there, then it is likely that the euro will continue to strengthen. It tends to make German exports very expensive, and weighs upon the export-driven index quite drastically. All things point to the probability that we will go higher, maybe due to the overall reflation trade that seems to be a global situation. After all, if countries are going to try to stimulate their economies, the market is likely continuing to see a lot of demand for German industrial goods.

To the downside, if we were to break down below the 13,000 level, then we need to pay attention to the 200-day EMA, which is currently at the 12,685 level underneath. I am not interested in shorting the DAX until we break down below the 12,500 level, something that seems like it would take quite a bit of momentum to make happen. Beyond the reflation trade, the DAX is considered to be the “blue-chip index” in Europe, so that gives it a bit of stability and what is almost certainly going to be a very difficult and nerve-racking type of global economy. Looking at the candlestick for the trading session on Tuesday, it looks like we are going to continue to see a lot of support underneath in general, so I remain bullish overall.