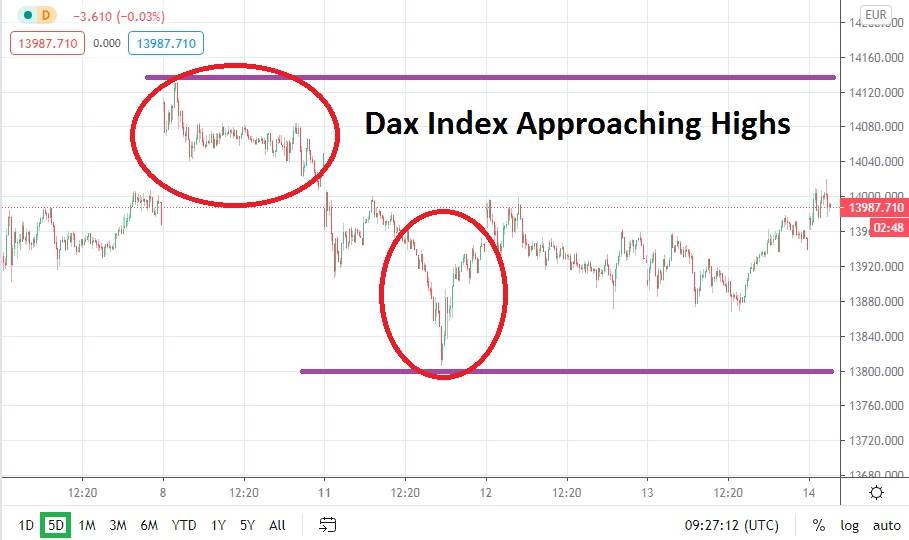

The DAX Index remains within shouting distance of record highs recently achieved and, in early trading this morning, has been able to create gains. The 14000.000 juncture is being battled and if this level is able to sustain values, it could entice speculators to try and join the party. After reaching a high of approximately 14129.00 before going into last weekend, the DAX Index experienced a wave of selling pressure which took the German index to a low of nearly 13810.00 on Monday.

However, after hitting this low water mark early in the week, the DAX Index has been able to demonstrate incremental buying and, interestingly, has not exhibited any harsh gaps, which are often part of the index’s trading landscape. The lack of volatile gaps in trading since reaching the low on Monday may signal that investment houses are active and confident.

Economic data from Germany published recently shows that the economy has sustained a 5% drop in its GDP the past year, but taking into consideration the implications of coronavirus, this number is not surprising and has not created any harsh reactions via investors. If the DAX Index is able to sustain its value above the 14000.00 in early trading today, it could set the table nicely for additional buying action to be facilitated if US equity markets prove to be optimistic later. Future calls from US equity indices are signaling a positive day ahead for the Dow Jones 30.

Speculators who are considering buying positions may also be intrigued by the notion that the DAX Index has been able to sustain its higher values and has not suffered from volatile sell-offs. When trading began after the New Year the DAX Index essentially began near a level of 13880.000 on the 4th of January. Yes, its value has been choppy, but after suffering a downturn on the 5th of January, which took the index to a low of nearly 13575.00, the DAX Index climbed higher until reaching its apex on the 8th – only 3 days later.

Speculators who believe that the bullish trend remains intact may find themselves hard-pressed to time the market. Instead, it may prove worthwhile to enter buying positions while pursuing positive trends upward. If the DAX Index shows an inclination to challenge support near the 14024.000 mark and US future calls on equity indices remain positive, it may be time to enter the DAX Index as a buyer and look for the potential of additional upside momentum.

DAX Index Short-Term Outlook:

- Current Resistance: 14024.000

- Current Support: 13975.000

- High Target: 14080.000

- Low Target: 13950.000