With more than 21,800,000 total infections and 200,000 new ones every day, the US remains by far the most infected country. Optimism over the availability of COVID-19 vaccines allowed the DJIA to surge to new all-time highs, despite less than 5,000,000 vaccinations to-date. The December goal was for 20,000,000. More debt and a soft labor market can lead to a massive sell-off following a breakdown below its resistance zone.

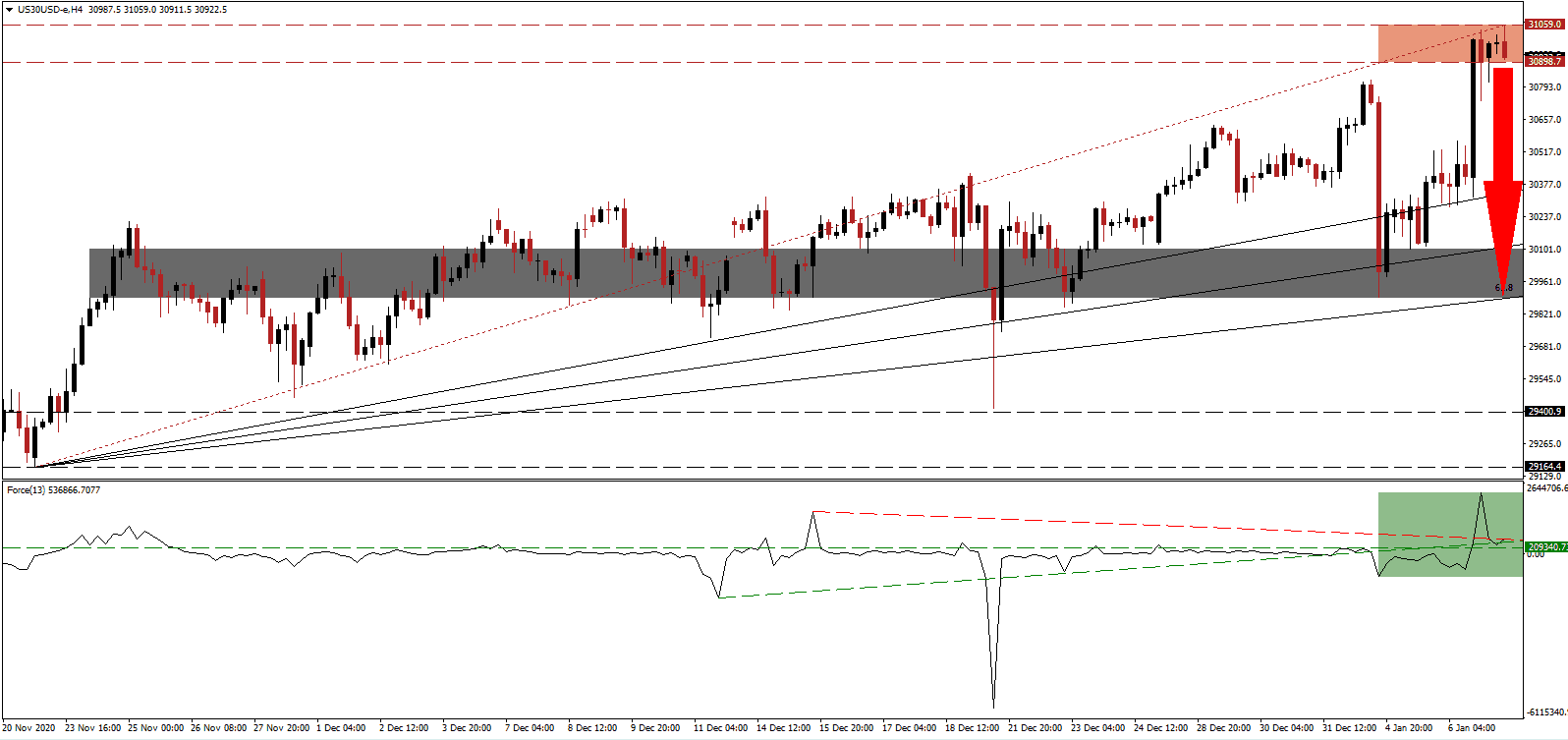

The Force Index, a next-generation technical indicator, retreated from a brief spike. It is now below its descending resistance level. Given the build-up in bearish momentum, a breakdown below its ascending support level can take it through its horizontal support level, as marked by the green rectangle. A move below the 0 center-line will place bears in complete control over the DJIA.

Political turmoil and civil unrest ahead of President-elect Biden’s inauguration are likely to persist, making his presidency one of the most challenging ones. Debt is set to explode, labor market weakness to persist, taxes to increase, and consumer demand to remain depressed. A pending breakdown in the DJIA below its resistance zone located between 30,898.7 and 31,059.0, as marked by the red rectangle, can spark a violent sell-off.

Yesterday’s ADP data showed job losses for December, as more states implemented stricter restrictions. Markets misprice the prospects of weakening economic data moving forward and throughout 2021. A profit-taking sell-off can take the DJIA into its short-term support zone between 29,888.6 and 30,101.7, as identified by the grey rectangle. The ascending 61.8 Fibonacci Retracement Fan Support Level enforces it.

DJIA Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 30,900.0

Take Profit @ 29,900.0

Stop Loss @ 31,100.0

Downside Potential: 10,000 points

Upside Risk: 2,000 points

Risk/Reward Ratio: 5.00

In case the Force Index eclipses its descending resistance level, the DJIA can attempt a breakout. Traders should consider more upside from present levels as an excellent selling opportunity amid a swiftly deteriorating outlook. The upside potential remains reduced to its next resistance zone between 31,369.6 and 31,526.4.

DJIA Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 31,250.0

Take Profit @ 31,500.0

Stop Loss @ 31,100.0

Upside Potential: 2,500 points

Downside Risk: 1,500 points

Risk/Reward Ratio: 1.67