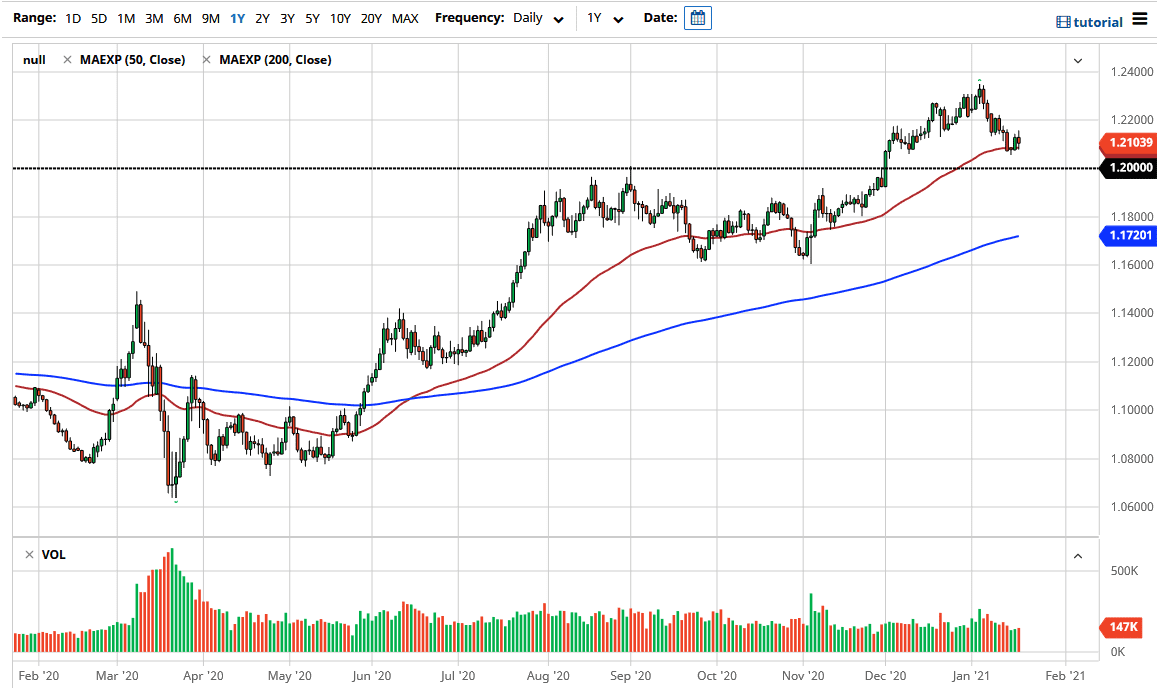

The Euro went back and forth during the trading session on Wednesday as we continue to hang on to the 50 day EMA. That is an indicator that a lot of people will pay attention to for some time, therefore I like the idea of looking for some type of opportunity here. However, it would not surprise me at all to see this market reached towards the 1.20 level underneath, which was a massive resistance barrier previously. After all, a certain amount of “market memory” should come into play there, so that is something to pay attention to. In general, this is a market that I think will eventually find reasons to go higher, not the least of which would be stimulus out the United States. However, the question now is whether or not the coronavirus situation in the European Union is going to get any better? After all, fines are is in the midst of having potential legal troubles due to the fact that they have not delivered what they promised as far as numbers of vaccine vials.

If we break down below the 1.20 level, then the market could go down to the 1.19 level. Ultimately, this is a market that I think continues to see a lot of noise but in general I think that we will see a testing of support underneath, perhaps giving the ability of short-term trader to go back and forth but I think longer term traders will probably continue to look towards the bullish side because of the stimulus situation. However, if we were to break down below the 1.19 level, then it could send this market break down from there. At that point, the 200 day EMA could be targeted, I think at the very least we are going to see a lot of choppy behavior but then again that is how this pair tends to move in general anyway. That being the case, I have no interest in trying to get too big with any of my positions, and I do realize that this pullback makes quite a bit of sense considering that the 1.23 level above had been important, and it essentially makes up a resistance barrier that extends all the way to the 1.25 handle. I believe that the next several weeks will be a simple back-and-forth type of market ahead of us.