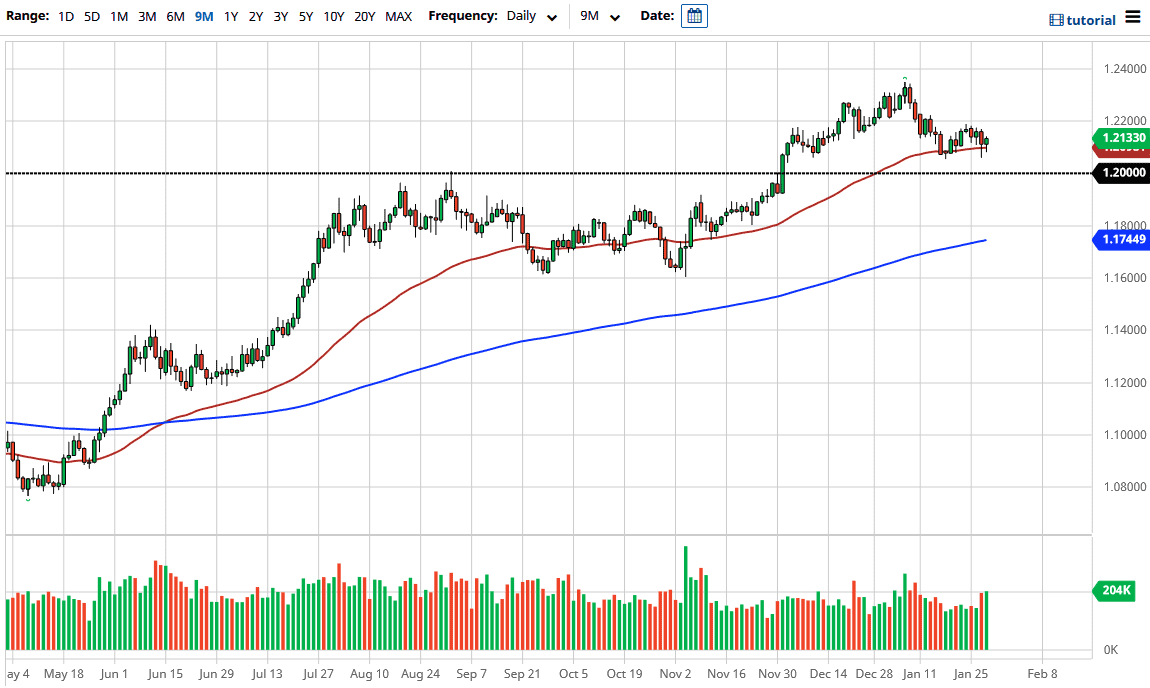

The Euro has initially fallen during the trading session on Thursday only to turn around and show signs of life again. The 50 day EMA seems to be offering relatively strong support, so at this point I believe what we are looking at is a technical indicator that a lot of people are looking to pay attention to. It is flattening out, so this suggests that we are going to perhaps be a little bit more sideways, and with that being the case I think what we are looking at is more of the same that we have seen over the last several weeks, meaning that the Euro might be rather choppy as we watch central banks battle it out.

To the downside, the 1.20 level has offered support, while the 1.23 level above has offered resistance. I think that is essentially the “playground” that the market is stuck in, and therefore I believe that we could see a little bit of a bounce, but I am not necessarily looking for some type of massive breakout anytime soon. This is due to the fact that the Federal Reserve is ultra-loose with its monetary policy, just as the European Central Bank is starting to talk about the same thing. Because of this, we might have a bit of a smaller currency war starting, and that means that the central banks are going to do whatever they can to keep their currencies relatively cheap. Unfortunately, this leads to very choppy and sideways trading in general, so that is what I am forecasting for this pair.

To the downside, I do believe that there is a significant amount of support extending from the 1.20 level underneath down to the 1.19 level, as we have seen it offer significant resistance in the past. That being said, if we were to break down below there then I think that the market probably then finds its way down to the 200 day EMA. To the upside, the 1.23 level extends all the way to the 1.25 level as far as resistance. If we were to break above the 1.25 handle, then the market is likely to go much higher, perhaps extending all the way to the 1.30 level but that needs some type of severe “anti-US dollar” type of situation. I think range bound trading systems will continue to be the best way forward.