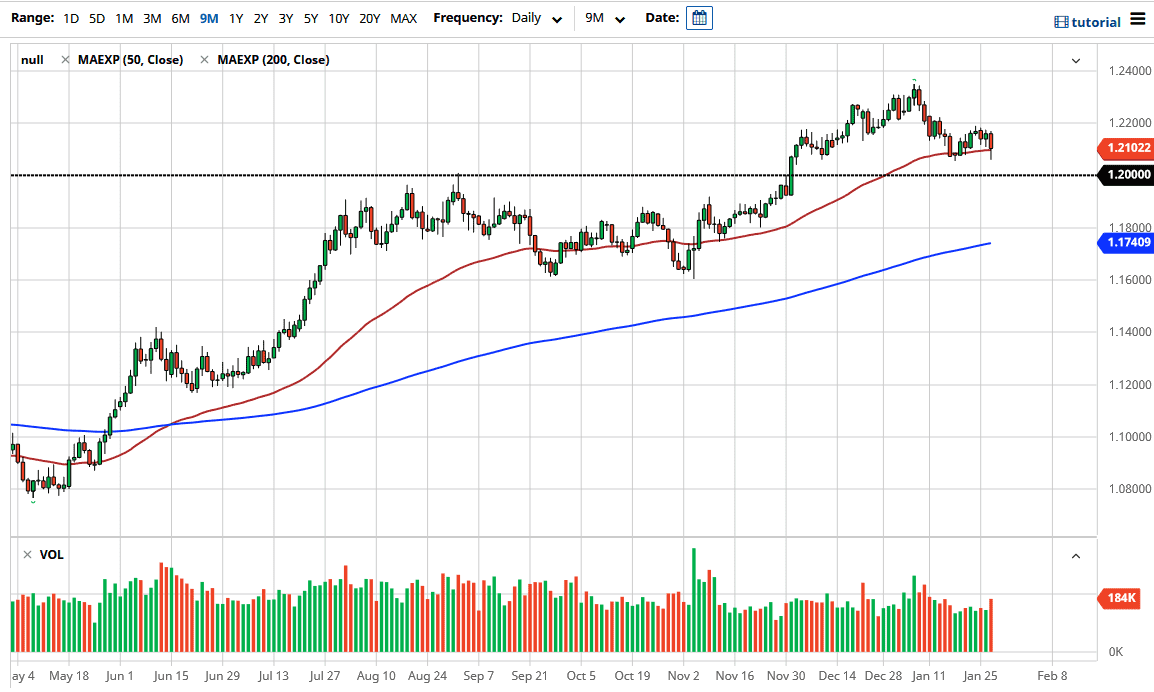

The Euro fell initially during the trading session on Wednesday, but we have seen the market recover by the end of the day. The 50 day EMA has been technical support, and we are now flirting with the 1.21 handle. The 1.20 level underneath that is even more supportive, so I think that it is only a matter of time before buyers would show up there as well. Looking at this chart, it appears that there is a significant amount of support at the 1.20 level underneath and significant resistance at the 1.23 handle. I believe that we continue to go sideways in general, as the market may have gotten a bit ahead of itself previously.

What I find very difficult about this pair right now is the fact that both central banks are doing what they can to destroy their own currencies and is now we have people from the ECB suggesting that they are starting to pay attention to the exchange rates. Over the last several months though, it certainly has been favorable for the Euro, and I think at this point we continue to see a general upward attitude, but it should be noted that the US Dollar Index is sitting on top a pretty significant support, and that does suggest that the dips will continue to be bought, but if we were to break down below the 1.19 level, then it could open up the floodgates to the downside.

To the upside, the 1.23 level is resistance that I think it extends all the way to the 1.25 handle. That is an area that I think will continue to be very difficult to break above, so it is not until we can break above the 1.25 level that I think that this market is free to go much higher. At this point in time, I think we are simply going to bounce around in a 300 point range, and it is worth noting that we are essentially closer to the bottom of the range. I think that a bounce is likely to be coming in the short term, but I would not look for a bigger move anytime soon. I think we are going to kill time going sideways in general, as we try to work off some of the initial froth in the marketplace.