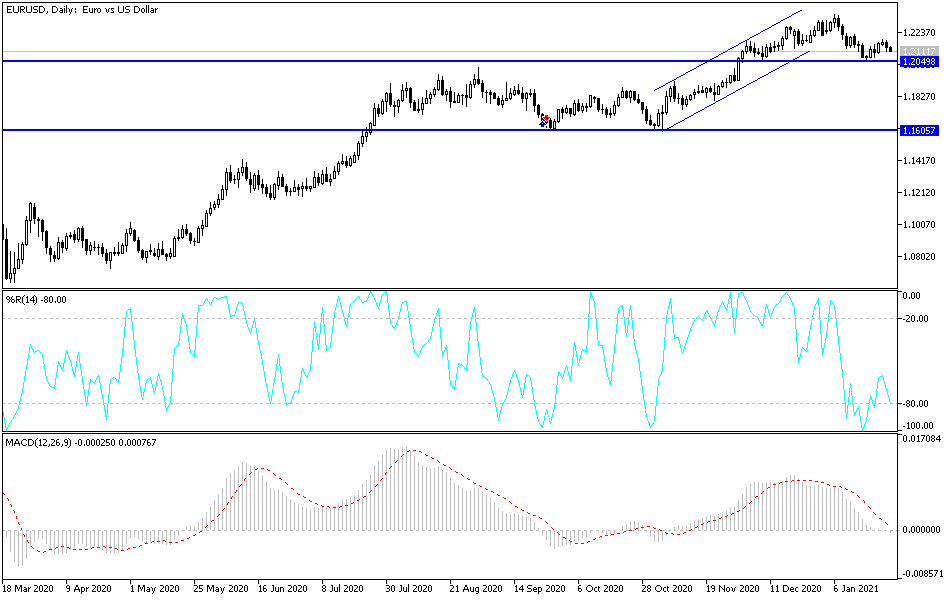

The euro initially fell during the trading session but continues to find plenty of support underneath, especially near the 50-day EMA. The 50-day EMA sits just below the 1.21 handle, so it continues to be supported. Underneath there, we have the 1.20 level which also attracts a certain amount of attention as well. The candlestick for the trading session suggests that we may get a bit of buying pressure sooner or later, but there are questions out there about whether or not we are going to see enough stimulus to truly drive the market higher.

One thing to think about is the fact that the European Central Bank may get involved as well, so we may have stimulus coming from both sides of the Atlantic. If that ends up being the case, then it is very possible that we may have very difficult trading conditions, which is not overly surprising for this pair at times.

Overall, I do think that the longer-term direction is probably still going to be to the upside, but it may take some time to get to a more significant level. Buying dips continues to be the best way forward, but I also recognize that the market may be a bit slow, and you are probably better off trading the US dollar against other currencies. However, if we were to break down below the 1.19 handle, that could open up further selling in the euro, but I think we are probably just going to chop back and forth in short-term day trading range-bound type of noise more than anything else.

If the stimulus is smaller than anticipated in the United States, that could put downward pressure on this market, but you never know; it is possible that the Federal Reserve will step in and do something as well to drive down the value of the greenback. Most pundits believe that the dollar will continue to fall over the longer term, but we may have a bit of work to do to get to that point. In the meantime, it is probably best to simply look at this as a short-term trading market at best.