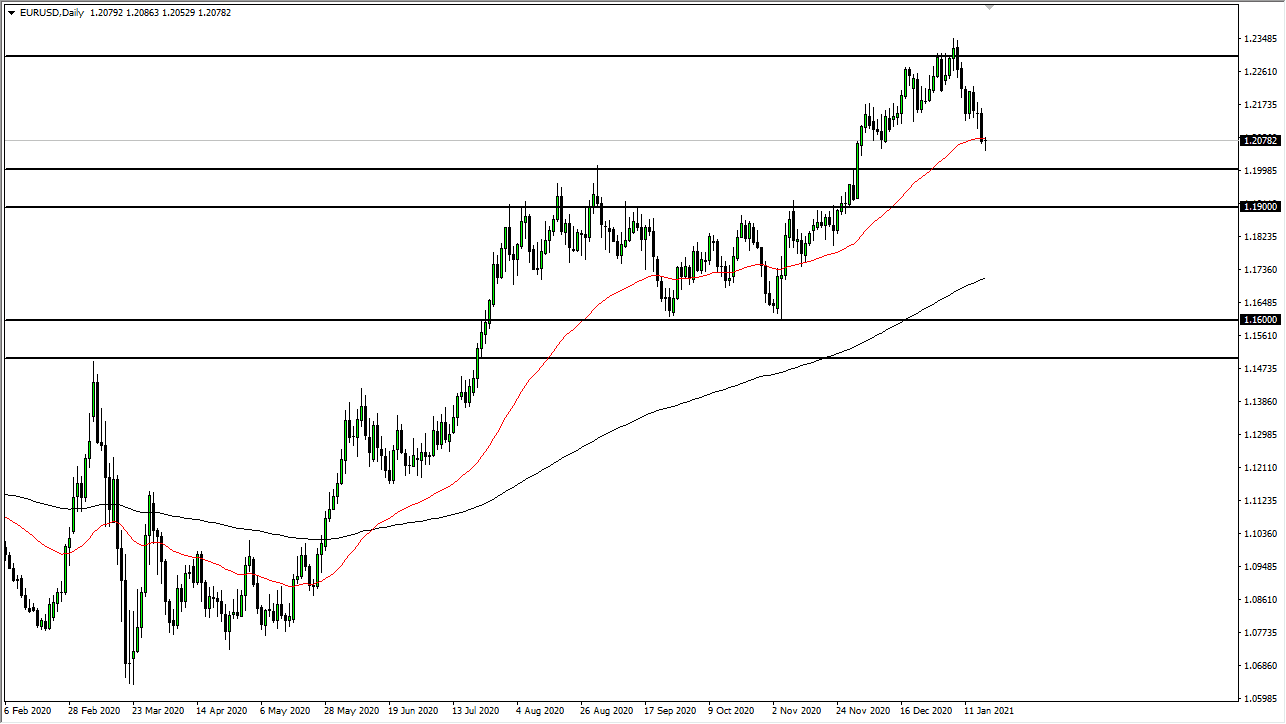

The euro initially fell during the trading session on Monday, but has recovered quite nicely as there does not seem to be a huge push to break it down in the short term. The market will continue to focus more on stimulus than anything else at this point. Yes, the European Union is locking itself down in little bits and pieces, but you could say the same thing about parts of the United States. Nonetheless, we are in an uptrend and testing the 50-day EMA. The market has even more support underneath, especially near the 1.20 level, extending down to the 1.19 level.

Looking at this chart, it is not a huge surprise that we pulled back from the 1.23 level, which on the long-term chart certainly has shown itself to be rather resistive. I think at this point we are more than likely going to continue to bounce around between the 1.20 level and the 1.23 level, as we try to figure out what to do next. The pair does tend to be very choppy in general, which is normal for normal times. I think the 300-point range that we are stuck in right now probably keeps this market somewhat consolidating, which makes sense considering that we had shot straight up in the air for a while. Furthermore, there are a lot of questions when it comes to stimulus, not to mention the question of how big it will be.

The market has a massive amount of resistance above the 1.23 level that extends all the way to the 1.25 handle, and I think it can it take several pullbacks like this in order to finally make a move above there. Furthermore, we almost certainly need to see the US dollar get absolutely crushed in general due to a massive stimulus bill or something like that, in order to break out to the upside for the sustainable move. Because of this, I think we have several weeks of fluctuation in this pair just waiting to happen, which is very common for the euro, as it is not a pair that tends to trend very easily a lot of the time. If you are a short-term trader, you have a couple of great levels to watch.