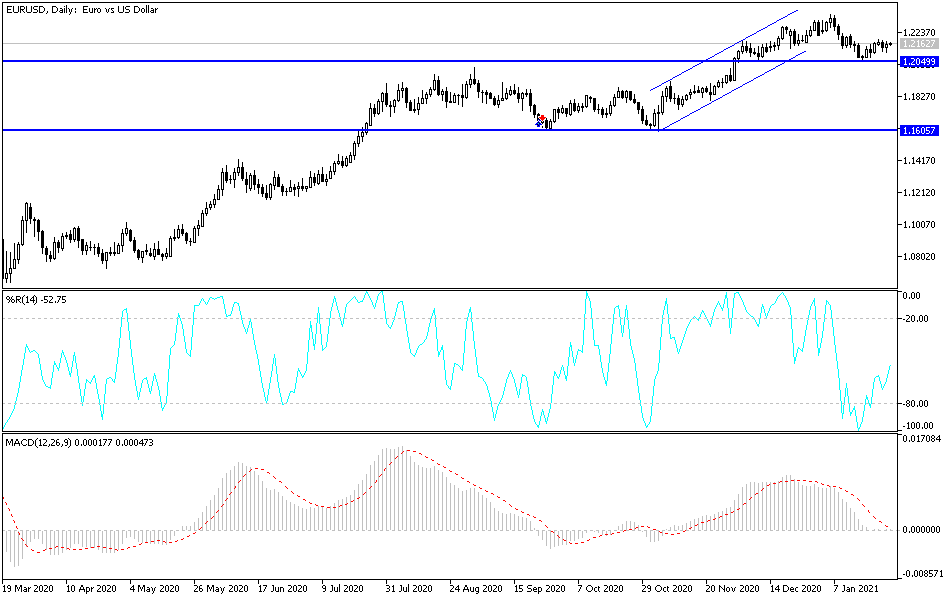

The euro initially fell during the trading session on Tuesday but continues to find buyers underneath. By doing so, we have ended up forming a hammer, which has bounced directly off the 50-day EMA. That is a good signal, but at this point we are still waiting to see what Jerome Powell has to say after the FOMC meeting and press conference. It will have a direct effect on what happens to the US dollar, which currently is the big driver of where this pair is going.

When you look at the European Union itself, there are concerns about the vaccine rollouts being slower than anticipated, so needless to say there are still people talking about the major lockdown situation in which the continent finds itself. It is difficult to get overly excited about the euro, or the European economy for that matter. At this juncture, the rollout of the vaccine is going to be one of the major headwinds to the economy, but people are trying to look beyond this temporary issue.

As long as people are banking on the reflation trade, it is probably only a matter of time before the euro gets a boost again, but I do believe that the 1.23 level above is going to be massive resistance. In the short term, if we were to break above the 1.22 level, especially if Jerome Powell is extraordinarily dovish, then we could make a run towards that 1.23 level. Above there, we have massive amounts of resistance that extend to the 1.25 handle, so I think that it would take quite a bit of work to get there.

To the downside, if we were to break down a bit, I believe that the 1.20 level will end up being massive support down to the 1.19 level. With that in mind, I am a buyer of dips, and have no interest in shorting this market anytime soon. That could change with a few errant words by Jerome Powell, but right now it looks like we are destined to test the top again, though we are also currently in the midst of two major areas of supply and demand. That almost always makes for choppy and difficult trading.