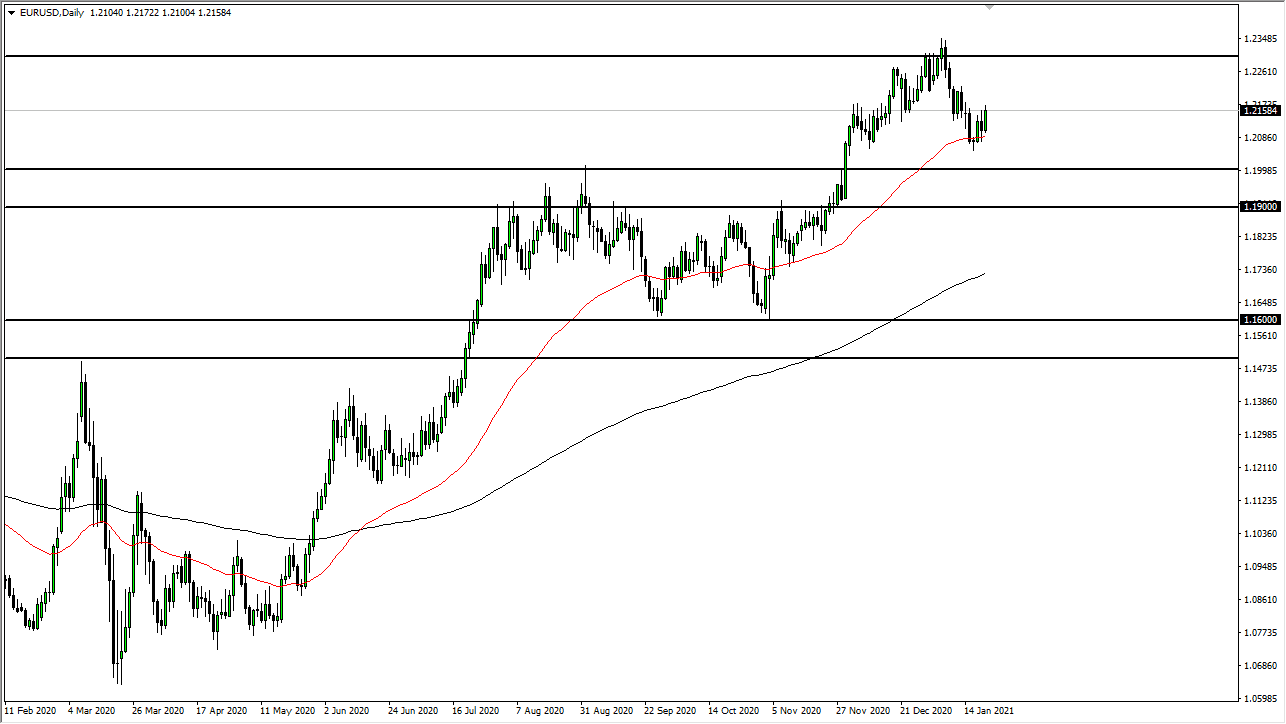

The Euro rallied a bit during the trading session on Thursday as it looks like we are going to continue to see a certain amount of upward mobility, but choppiness of course will be a major problem as well. Looking at this chart, we have bounced a bit from the 50 day EMA which is a technical recovery, but at this point in time I think that we are looking at a market that is trying to recover from what has been a corrective phase. When you look at the chart, it is obvious to see that we have been in an uptrend for a while, but the pullback was rather severe. When you look at the weekly chart, there are a couple of shooting stars near the 1.23 handle, so that shows just how resistive it is in that general vicinity.

Looking at this chart, I think that the 1.23 level above is going to be very difficult to get beyond, as it has shown resistance a couple of times, and based upon the structure from previous trading it looks as if the 1.25 level is the top of that “range of resistance.” To the downside, I see a significant amount of support near the 1.20 level that extends down to the 1.19 handle. In other words, we are essentially stuck in a range that continues to be very significant to the market. I think at this point in time the Euro is paying close attention to the stimulus talks in the United States, but now after the ECB meeting on Thursday, Christine Largarde has suggested that perhaps the ECB could do more stimulus if needed. In other words, I think the upward trajectory of this market is certainly going to slow down.

At this point in time, it is going to become a battle between two central banks and that is about it is difficult to deal with the times. I do believe that this is a market that will be very choppy to say the least, so I suspect that in the near term we are going to bounce back and forth between these two major areas. As we are roughly in the middle of these two areas, I do not really have an opinion right now and I feel very neutral when it comes to this currency pair.