Bearish case

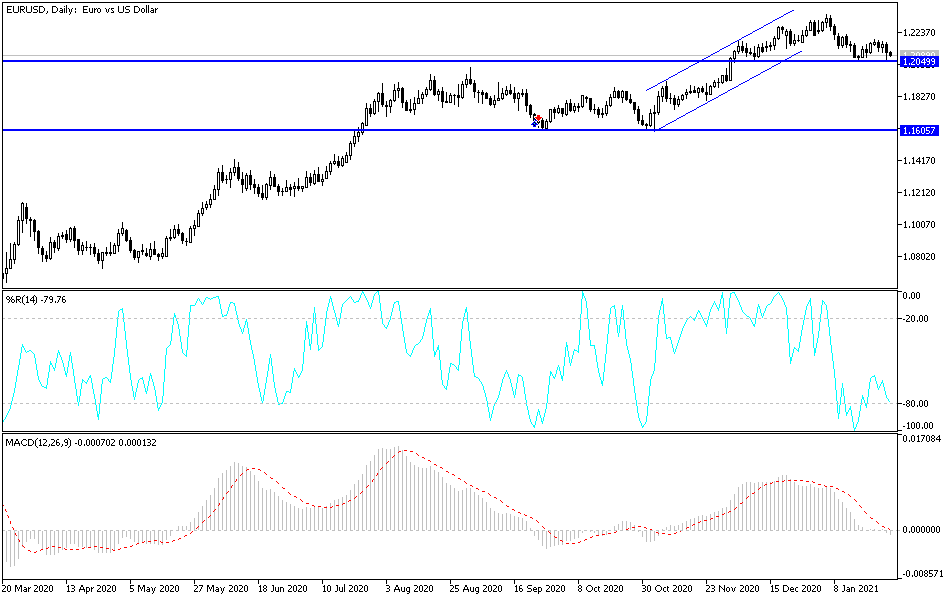

Set a sell-stop at 1.2045, or slightly below 1.2050.

Add a take-profit at 1.2000 and a stop loss at 1.2150.

Bullish case

Set a buy-stop at 1.2150 and a take-profit at the resistance at 1.2190.

Set a stop loss at 1.2045.

The EUR/USD struggled after more data from Europe showed that the economy was headed for a potential contraction in the first quarter. It also declined after the Federal Reserve Open Market Committee (FOMC) delivered its first interest rate decision of the year.

European Weakness and Fed Decision

Early this week, data by the IFO Institute showed that German businesses were pessimistic about the current and future prospects of the economy due to the coronavirus pandemic. The business climate, current assessment and business expectations all dropped to 90.1, 89.2, and 91.1, respectively, in January.

Yesterday, further data by GsK showed that the German consumer climate also declined to -15.6 in January. Similarly, in France, the consumer confidence declined from 95 to 92. These numbers are sending a signal that the European economy is heading towards a contraction in the first quarter.

Later today, the EUR/USD will react to the Eurozone business and consumer confidence numbers. In general, economists expect the industrial and services sentiment will drop to -7.2 and -18.8, respectively.

Meanwhile, the EUR/USD is reacting to the FOMC interest rate decision. As widely expected, the Fed decided to leave interest rates unchanged at the range of 0.0% and 0.25%. Also, it decided to continue with its quantitative easing policy at the rate of $120 billion per month. In the statement, low interest rates help to support borrowing, spending and investments by both individuals and businesses.

However, the Fed warned that the economic growth experienced in the third quarter will not last. Later today, the EUR/USD will react to the first reading of US Q4 GDP economic data. Economists expect a slower recovery helped by the robust consumer spending. Also, the pair will react to the US jobless claims numbers.

EUR/USD Technical Outlook

The EUR/USD dropped to 1.2050 after the FOMC decision. This was a notable price since it was the lowest level it has been this year. On the four-hour chart, the 25-day and 15-day exponential moving averages have made a bearish crossover pattern. Also, it has formed a double-top pattern at the 1.2190 level.

Therefore, a complete break below 1.2050 will be a sign that bears have prevailed and will open the possibility of it moving below 1.2000. The invalidation point for this prediction is the 25-day EMA level at 1.2150.