Bullish ideas

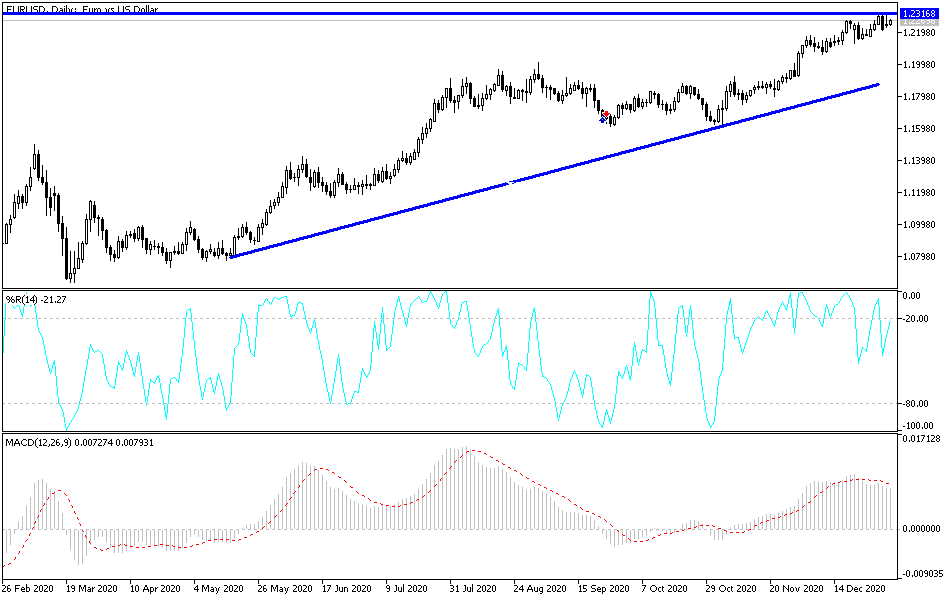

Buy the EUR/USD hoping the bullish trend will continue.

Put a take profit at the psychological level of 1.2300.

Add a stop loss at 1.2200

Bearish ideas

Short the EUR/USD hoping for a pullback.

Put a take profit at 1.2200.

Add a stop loss at 1.2300.

The EUR/USD pair is holding steady near its two-and-a-half-year high as traders react to the mixed Manufacturing PMI data and the upcoming Georgia runoff election.

Manufacturing Sector Steady

The global manufacturing sector continued to hold steady in December even as the number of coronavirus cases continued to rise. In a report yesterday, Markit said that the overall Manufacturing PMI in Europe dropped from 55.5 in November to 55.2 in December. This reading was slightly below the median analysts’ estimate of 55.5.

In Germany, the PMI dropped from 58.6 to 58.3 while in France, it emerged from 49.6 to 51.1. The Italian and Spanish PMI also rose in December. Meanwhile, in the United States, the Manufacturing PMI rose from 56.5 to 57.1.

These numbers came as the world continues to address the rising COVID-19 cases and the new strain of the virus. Indeed, in a statement yesterday, Angela Merkel said that Germany will extend its lockdown by about three more weeks. Other countries will also extend these lockdowns even as the vaccination process gains pace.

Georgia Senate Election

The biggest catalyst for the EUR/USD will be the Senate election in Georgia where the Republican incumbents are facing energized Democratic opponents.

A win by the Democrats will give Joe Biden the votes he needs to accomplish his agenda that includes higher taxes and more stimulus. More stimulus will possibly be negative for the US dollar.

If Republicans win at least one seat, it will lead to gridlock in Washington, with Mitch McConnell as the Senate leader. As a result, he will have the power to block most of Biden’s ambitious proposals while leaving most of Trump’s policies intact.

The EUR/USD will also react to the ISM Manufacturing PMI data. Analysts expect the data to show that the Manufacturing PMI declined from 57.5 to 56.6.

EUR/USD Technical Outlook

The EUR/USD price has been on a strong rally recently. On the daily chart, it remains above the 15-day and 25-day exponential moving averages. However, the Relative Strength Index (RSI) shows that divergence is happening. Similarly, the Average Directional Movement Index (ADX) has flattened. Therefore, in the near term, while the pair will possibly continue rising, a pullback to the support at 1.2012 is also possible.