Bearish case

Sell the EUR/USD as it finds some support at the 38.2% Fib level.

Have a take profit at 1.1985, which is slightly above the 50% retracement level.

Set a stop loss at 1.2157.

Bullish case

Have a buy stop at 1.2157, which is slightly below the 23.6% retracement.

Add a take-profit at 1.2270 and a stop loss at 1.2100.

The EUR/USD pared-back some of the earlier losses ahead of the important Eurozone inflation data and the European Central Bank (ECB) interest rate decision. It is trading at 1.2094, which is slightly above yesterday’s low of 1.2053.

ECB Decision Ahead

There will be no major economic data from the European Union and the United States today. Therefore, focus will be on the final Consumer Price Index data set for tomorrow and the ECB decision scheduled for Thursday.

Economists, based on the flash CPI released two weeks ago, expect the overall Eurozone inflation to remain relatively low. In general, the median estimate is for the headline CPI to have declined by 0.3% in December. Similarly, they expect the core CPI to have risen by 0.4%. In contrast, the headline and core CPI in the United States rose by 1.4% and 1.6% in December.

The inflation data will come on the same day that the ECB will begin its first monetary policy meeting of the year. Economists polled by Reuters expect that the bank will leave its interest policy unchanged. Similarly, it will leave its quantitative easing program intact. As a result, the EUR/USD pair will probably not have a significant reaction to the decision.

Still, the meeting comes at a difficult time for the Eurozone economy as the number of coronavirus cases continue rising. In fact, economists polled by Reuters expect the Eurozone economy to have declined by 2.5% in the fourth quarter. They see it rising by 0.6% this quarter amid the lockdowns.

The EUR/USD will also react to Joe Biden’s inauguration as the next American president. Last week, he unveiled a $1.9 trillion stimulus package that he hopes will go a long way to support the economy.

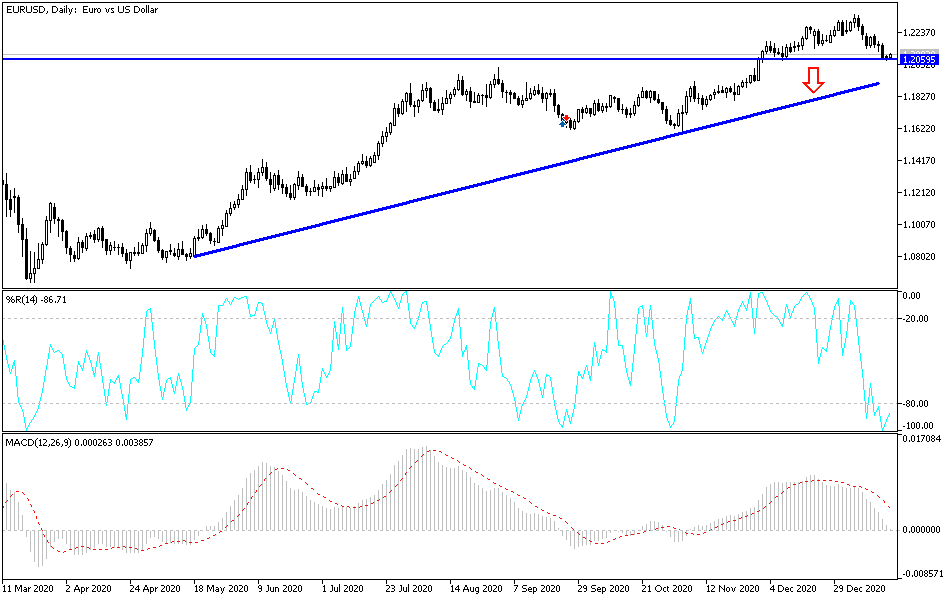

EUR/USD Technical Outlook

The EUR/USD pair has been moving in a downward trend in the past few days. On the four-hour chart, it dropped to a low of 1.2050, which was along the 38.2% Fibonacci retracement level. The pair has also moved below the 25-period and 15-period exponential moving averages while the two lines of the MACD are below the neutral line.

Therefore, I suspect that the pair will resume the downward trend in the near term. If this happens, bears will likely eye the 50% retracement at 1.1.1975. On the flip side, this price action will be invalidated if it moves above the 23.6% retracement at 1.2170.