Bearish case

Set a sell-stop at 1.2116.

Add a take-profit at 1.2055

Set a stop-loss at 1.2186.

Bullish case

Set a buy-stop at 1.2186.

Add a take-profit at 1.2250 and a stop-loss at 1.2100.

The EUR/USD is wavering today after the relatively weak German sentiment data signalled to a double-dip recession in Europe. The pair is also holding tight ahead of the Federal Reserve interest rate decision.

Europe Worsening Outlook

The outlook for the European economy is relatively dire, according to the latest IFO Institute sentiment data. The numbers showed that the German business climate data fell from 92.2 to 90.1 in January. Business expectations declined from 93.0 to 91.1 while the current assessment fell from 91.3 to 89.2 because of the rising worries of the pandemic.

As the biggest economy in Europe, Germany tends to set the tone on many issues. Therefore, there is a possibility that the situation is like that in other European countries like France, Italy, and Spain. The official business and consumer climate numbers will come out on Thursday.

The EUR/USD is also holding steady as the Federal Open Market Committee (FOMC) prepares for its first meeting of the year. Most economists expect that the central bank will leave its interest rates unchanged. Also, they expect the bank to continue with its asset purchases as it continues to support the economy. Still, the pair will react to the dot plot and the language of the monetary statement.

Meanwhile, the EUR/USD is also reacting to the stimulus issues in the United States. In the past few days, several important senators have opposed some of the provisions of the $1.9 trillion proposal issued by Biden. For example, there have been concerns about whether all Americans should get the $1,400 stimulus check. Some moderates argue that the check should go to only the neediest Americans.

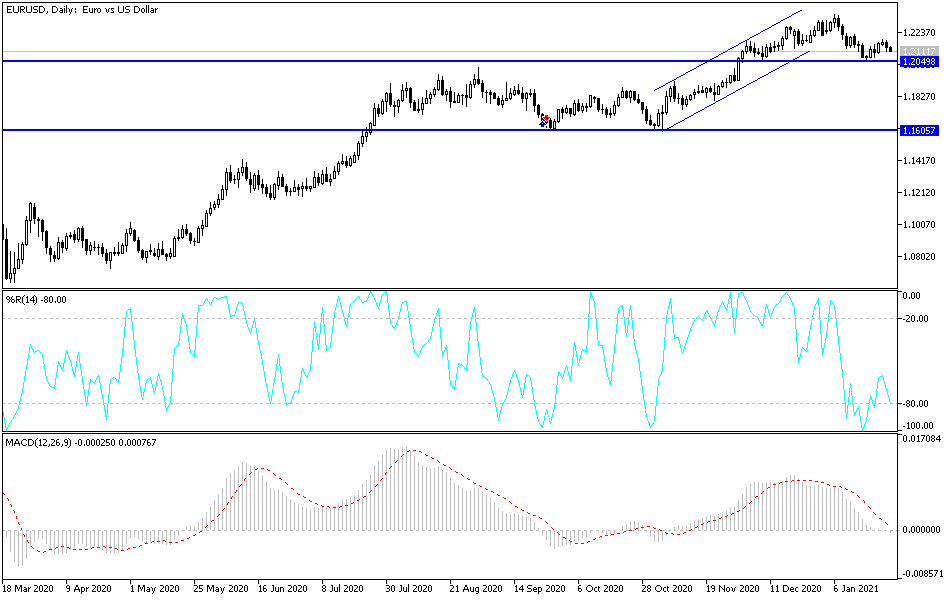

EUR/USD Technical Outlook

The EUR/USD pair has dropped by more than 1.75% from its year-to-date high of 1.2354. On the four-hour chart, the pair is slightly below the 23.6% Fibonacci retracement level. Notably, it is slightly above the second support of the Andrews Pitchfork tool. This is after its attempts to move above the first support failed yesterday.

The pair has also formed a head and shoulders pattern and is currently slightly below the right shoulder. It has also formed a bearish flag pattern. Therefore, the pair will likely break-out lower in the near term. If this happens, the key level to watch will be the YTD low at 1.2055, which is also along the 38.2% retracement. The alternative scenario is where the pair bounces back and retests the first support at 1.2200.