Since the start of trading this week, the EUR/USD has been in a new descending correction range that settled around the 1.2128 level as of this writing. With this new correction, technical analysts see that there is room for the euro to rise further in the coming days, despite the shaky global markets and economic risks. The euro got some support after IHS Markit PMI surveys for January indicated that the continent's manufacturing and services sectors are holding up better than expected this month.

Many European companies and households have spent this month in a renewed state of "lockdown" even though the resulting declines in PMI surveys were much smaller than those seen in the UK. The PMI surveys enabled the euro to build on the momentum that began when European Central Bank Governor Christine Lagarde said last Thursday that it may not be necessary for the bank to use all of the new funds earmarked for the pandemic-inspired quantitative easing program.

Some observers considered Lagarde's remarks less "pessimistic" than expected, although the head of the European Central Bank would have the opportunity to explain the kinds of circumstances in which the bank might not use the 1.85 trillion euros it has set aside. Commenting on this, says Juan Manuel Herrera, Forex Analyst at Scotiabank, said: “The euro is now more clearly a bullish reversal from the middle of the month as it is forming a strong bullish trend since a crossover below the 1.21 level which puts it on the right track to test the 1.22 level. The 1.22 mark practically acts as the midpoint of the euro’s decline in the period of January 7th To January 18th, and a cross above this indicator may slow the euro for a short period of time as it gains around 1.2225; 1.2236 is a 61.8% Fib retracement.''

The euro’s gains at the end of last week’s trading came on the back of widespread declines in stock markets and other risk assets with which it usually enjoys a positive relationship, and gave technical analysts the impression that an early downward correction may be now. It ran its course.

On the future of the EUR, Karen Jones, Head of Technical Analysis for Currencies, Commodities and Bonds at Commerzbank says: “The EUR/USD pair has rebounded from the 55-day moving average at 1.2081. It is possible that this bearish correction has completed and we will have to neutralize it, as the next move in the markets may continue. In the medium term, the market continues its path to the upside, targeting the 1.2556 and 1.2624 levels, the 200-month moving average, which remains our long-term target.”

The euro had traded as high as 1.2350 earlier in January and can now seek to regain that level before moving to higher and better levels, although in doing so, the euro will also have to contend with shaky global markets and investor confidence. A cautious Eurozone economic outlook due to the delay in launching vaccines in Europe is affecting sentiment towards the euro.

An undisclosed manufacturing problem has led Astrazeneca to warn that vaccine deliveries to European countries will be much lower than agreed upon in the coming months. Politico reported over the weekend that at rates achieved last week, Europe will have only 15% of the adult population vaccinated by then, which means vaccinations will need a five-fold increase to achieve the goal.

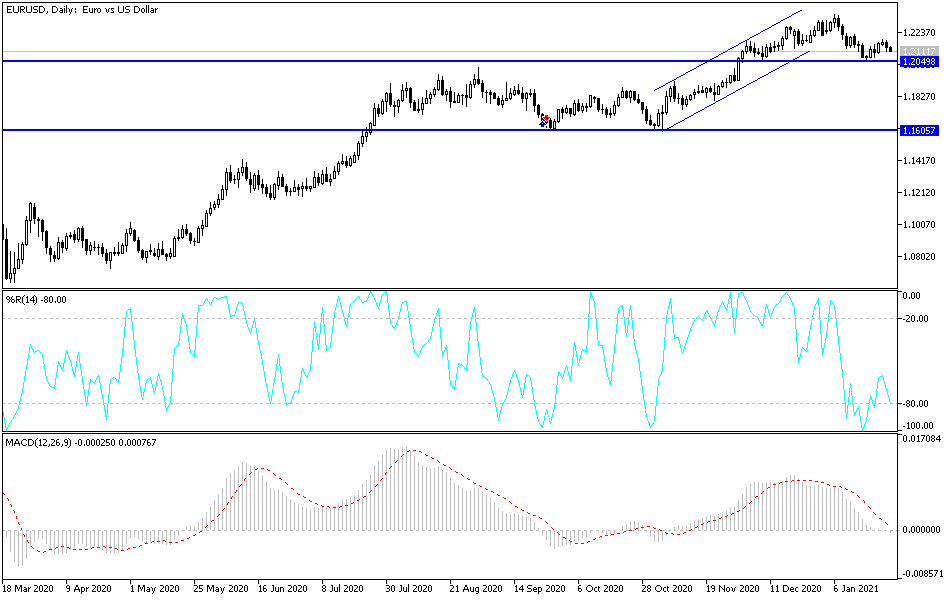

Technical analysis of the pair:

On the daily chart, the EUR/USD pair is in a neutral position with a tendency to the downside, especially if it moves below the 1.2100 support level, which may catalyze a move to the psychological support of 1.2000. Bulls will wait for the pair to stabilize above the 1.2300 resistance level to complete the ascending path.

In the coming hours, the euro will be affected by the extent of investor risk appetite, as well as European efforts to contain the outbreak of the coronavirus, US stimulus news, and the release of the US Consumer Confidence reading.