The euro jumped more than half a percent against the US dollar, hinting at a positive mood among investors just hours before the Georgia Senate runoff elections. The EUR/USD pair jumped to the resistance level of 1.2310 before settling around the level of 1.2240 in the beginning of Tuesday's trading.

The EUR/USD pair's gains were likely due to a weak US dollar, not a strong euro. “The dollar’s weakness has been observed in all foreign exchange markets as traders prepare for a year of economic recovery,” said Joshua Mahoney, Senior Market Analyst at IG. In general, the US dollar tends to exhibit an inverse relationship with investor sentiment, as it rises when investors are fearful and markets are down. Thus, the current environment of higher markets is usually a negative background for the dollar.

The rise of the euro against the USD comes at a time when Europe continues to confront the COVID-19 pandemic and implement more lockdown restrictions. Accordingly, Michael Brown, Chief Market Analyst at CaxtonFX, says, “The euro continues to challenge gravity as far as the economic fundamentals of the bloc, as it trades at the highest level in 3 years against the dollar. It must be emphasized that while the Eurozone remains unattractive in terms of its advantages, this move is largely the result of a significant dollar weakness.”

Therefore, the dollar remains the main factor in the exchange rate forecast, which means that interest will likely drop this week to the outcome of the senate election races in the US state of Georgia. The outcome of the vote will determine which party wins control of the Senate. Should the Democrats win, they would have control of the entire US government.

The general rule adopted by the market since 2020 is that the blue wave will be positive for stocks and commodities and negative for the US dollar, as increased stimulus measures are positive for economic growth, in the short term. Hence, according to analysts at investment bank MUFG, the vote result could be "pivotal" for the markets. Lee Hardman, a currency analyst at MUFG in London, says: “It will likely be one of the biggest market reactions in the US Treasury market if the Democrats exceed expectations and occupy both seats. This will open the door to a much greater fiscal stimulus package under the next president, Joe Biden. In the short term, risky assets are likely to be welcomed by the outlook for US fiscal stimulus as it will help boost the global recovery. It should ensure that the US dollar continues to weaken for the time being, even if US yields increase. In return, the market reaction should be limited iif the Republicans adhere to control the Senate.”

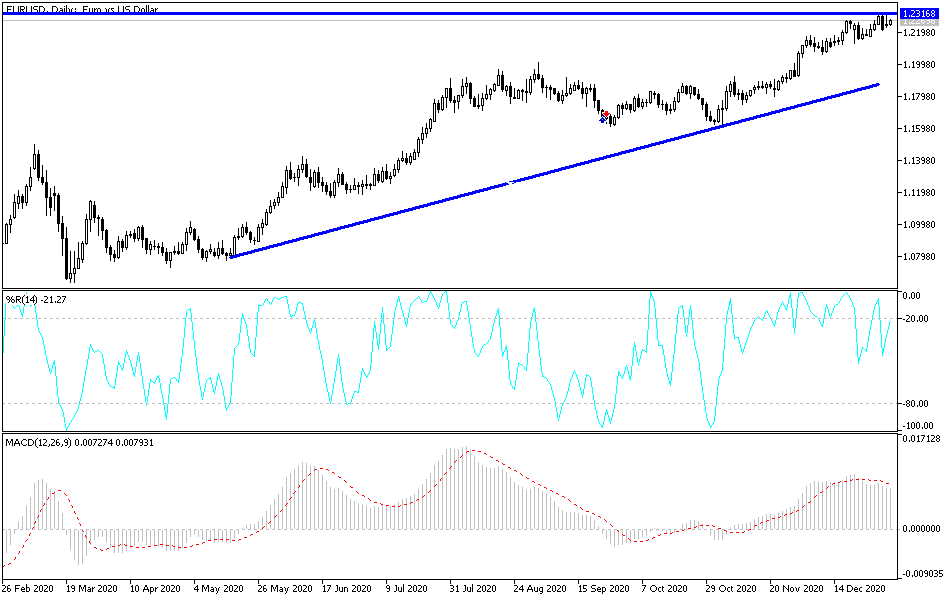

Technical analysis of the pair:

Despite the stalled gains of the EUR/USD, the general trend on the daily chart remains bullish as long as it remains stable above the 1.2000 resistance. The currency pair moves technical indicators to overbought areas any time there is a profit-taking sell-off, and Forex investors should think about that, especially if the pair moves towards the resistance levels of 1.2330, 1.2400 and 1.2465. Global fears of the coronavirus may return investors' attention to the US dollar as a safe haven, and thus the pair's gains may be negatively affected. More restrictions mean more concerns and thus a stronger dollar. On the downside, the first stop for the bears to control the performance will be moving towards the support levels 1.2145 and 1.2055, respectively.

Today's economic calendar:

For the euro, German retail sales, changes in Spanish and German unemployment and Eurozone money supply will be announced. Regarding the USD, the announcement of the ISM Manufacturing PMI reading will be released.