The EUR/USD is still within a downward correction range, having plummeted to the 1.2058 support level in yesterday's session before settling around the 1.2100 level as of this writing. Investor risk appetite has weakened, which is good for the US dollar. The European Union is facing obstacles to their vaccination campaign, which weakened market optimism, which was strong at the beginning of this year. The pair interacted with the most important event of this week, which is the US Federal Reserve’s announcement of its monetary policy, and as expected, it kept the US interest rates unchanged and confirmed that they will remain so even after the epidemic is eliminated.

Markets are again watching the European Central Bank's (ECB) reaction to the euro’s gains in the Forex market.

Monetary policymakers at the European Central Bank are said to be investigating the extent to which the EUR/USD rally in 2020 was driven by differences between the monetary policies of the ECB and the Federal Reserve Bank (Fed), with the aim of determining whether to take balancing action, according to a report from Bloomberg News. The review is likely to be an initial step towards linking the euro’s appreciation more clearly to persistently insufficient inflation in the Eurozone, and thus we could ultimately see policy decisions being taken at least partially in response to the impact of currency fluctuations on expectations of price pressures.

“This unusual focus on exchange rates seems to confirm our concerns that the European Central Bank is increasingly willing to use the euro as a scapegoat for not achieving its inflation target,” said Esther Reischilt, analyst at Commerzbank. At this stage, it will be a very small step to conclude that due to the rise in the euro, more easing in monetary policy may be needed. She added that the European Central Bank may work to stop the gains of the euro, and also it seems that the EUR/USD's highs are not attractive at present.

Recently, the dollar has been widely sold, and many analysts still expect US exchange rates to decline further in 2021. The euro has been one of the most popular destinations for runaway capital, although the resulting increase in the EUR/USD is threatening. Now negative inflation pressures are already entrenched. European inflation rates have remained well below the European Central Bank's target of “near 2% but less than 2%” for years despite the bank’s efforts to stimulate the economy to achieve the expected rate growth.

Commenting on this, Pipan Ray, Forex analyst at CIBC Capital Markets says: “If the European Central Bank is serious about resisting the strength of the EUR, and the implications of the domestic inflation target, it will consider confirming that inflation excesses will be tolerated in the next cycle. Accordingly, it is expected that the review of its own policy will be completed at some point this year. If that is the case, we will have to re-examine our strategic view of the US dollar to account for this shift. Until then, our bearish bias for the USD this year will continue.”

The Cypriot Minister of Health said that the steady decline in new infections after three weeks of Cyprus' nationwide lockdown allows for the start of the gradual reopening. The first places to reopen from February 1 will be hair and beauty salons, followed by retail stores, shopping centers and elementary schools a week later. Commenting on the vaccines, the Minister of Health said that despite the delay in purchasing the vaccine, the authorities are optimistic about compensating the losses because the authorities have ordered "much more" vaccine doses than the country's 900,000 people.

Amid another wave of COVID-19, Spanish health authorities are running out of vaccines and have had to postpone vaccinations for health workers and nursing home residents due to delays in deliveries by pharmaceutical companies. Spain, along with the rest of the European Union, has recently suffered delays in vaccinations, since Pfizer announced two weeks ago that it would temporarily cut deliveries so it can modernize its plant in Burs, Belgium.

However, the European Union is pressing all vaccine companies to ensure that they carry out promised deliveries. Spain reported more than 40,000 new confirmed infections in the past 24 hours on Wednesday, bringing the total to 2629,817. Another 492 casualties increased in the past 24 hours, bringing the total death toll there to 57,291.

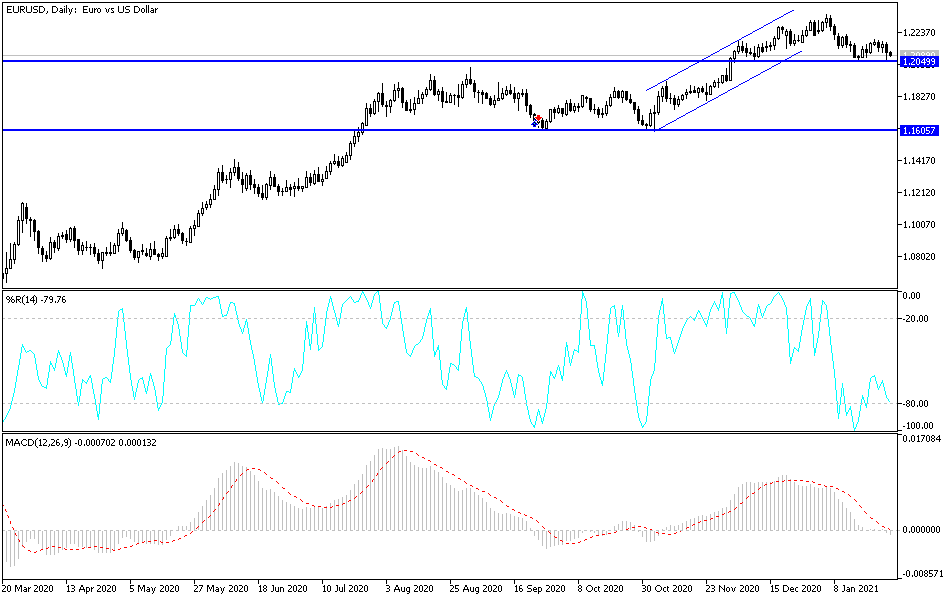

Technical analysis of the pair:

On the daily chart, the EUR/USD is pursuing a bearish trend, especially if it breaks through the support levels of 1.2050 and 1.1985. On the upside, the pair will move bullish if it stabilizes above the 1.2300 resistance.

The currency pair will be affected in the upcoming trading sessions by the progress of European vaccination campaigns, the US and European stimulus plans, and the rate of growth of the US economy in the fourth quarter of 2020. Also, we expect the release of the number of weekly unemployment claims and new US home sales.