The EUR/USD pair stabilized near the 1.2075 support level during Monday's trading session, after falling to that level last week in its biggest loss in over a month. This correction came after the pair reached its highest levels in several years at the beginning of trading in 2021, due mainly to profit-taking. The US dollar recovered after strong gains in US bond yields, which ended their best week in months last Friday. At the same time, analysts cited several factors contributing to the euro’s weakness, including a prolonged “lockdown”, petering vaccination and political uncertainty in Italy. However, the European Central Bank's (ECB) seems unconcerned regarding the euro’s strength.

Commenting on the pair's performance, Stephen Gallo, European Head of Forex Strategy at BMO Capital, says: “Whatever your point of view, it is still great to hear the head of a major central bank highlight the 'positive' factors affecting the global economy while verbally speaking about their own currency.

Usually, bearish opinions abound when it comes to the prospects for the dollar in 2021, and these pessimistic forecasts explain why many forecasters are looking for the euro-dollar exchange rate to reach 1.25 sooner or later, which is the highest since the opening of trading in 2018. But the central bank may have other ideas in the event that there is no increase in the exchange rate from the pound to the euro or more sharp declines in the value of the US dollar relative to the Chinese yuan."

This is because without the latter, any recovery in the EUR/USD pair would return the euro to problematic levels. At last week's peak at 1.2350, some Eurozone trade-weighted exchange rate measures had already risen above the August-September 2020 high, which itself was higher than the peak achieved even in the pre-2017 EUR/USD rally that was had already. Finally, you see the accepted bids and offers around 1.25.

"ECB Governor Lagarde frustrated the EUR bulls with statements that the ECB is 'very concerned' with the effect of Forex on inflation," says Carol Laulhere, Forex strategist at Societe Generale. "The political crisis in Italy and the resulting expansion in the BTP/Bund to 121 basis points did not help in this matter."

In general, currency strength is a problem for central banks when inflation is far from the levels stipulated in their legal mandates, and the European Central Bank has long struggled to achieve its inflation target.

Many analysts say that the dollar's decline is just a correction of a long overvaluation. This may be the reason why ECB Governor Christine Lagarde has been making an effort to emphasize that the ECB's objections are not driven by concerns about export competitiveness, but rather lower costs of imports and how they could feed on lower inflation for a longer period. Regardless of whether it is the import or export side of the equation, the dollar, yuan and the pound sterling are still collectively responsible for more than half of the weighted exchange rate for trade in the Eurozone in every direction, and do not even come close to matching in individual volumes with any other currencies.

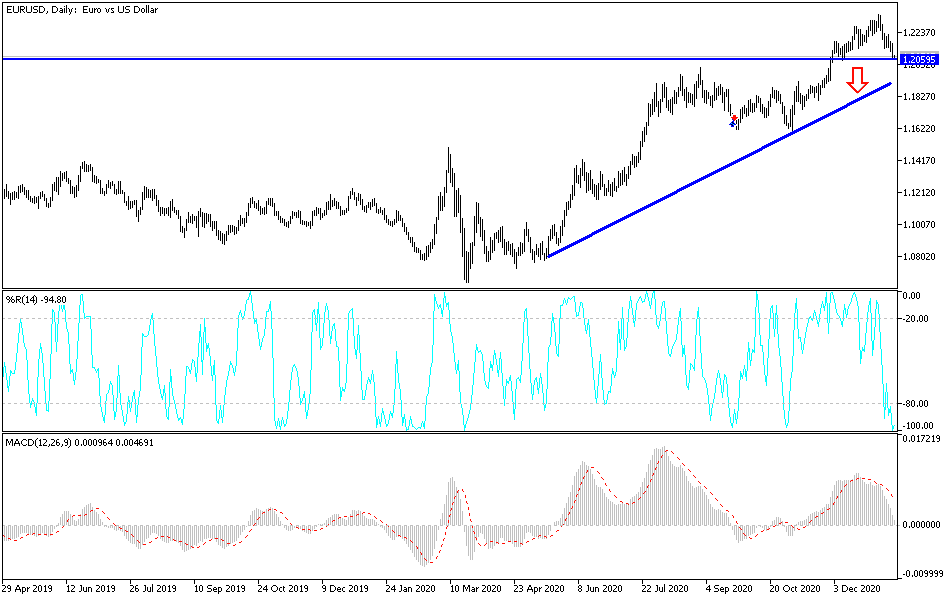

Technical analysis of the pair:

According to the performance on the daily chart, the EUR/USD pair would be bearish in the event of a move below the psychological support level of 1.2000. At present, the closest support levels for the pair are 1.2035, 1.1965 and 1.1880. On the upside, the stability of the currency pair must return above the resistance 1.2300 to confirm the bullish outlook that the currency pair enjoyed at the beginning of trading in the new year 2021. I still prefer to sell the currency pair from every upward level.

Today's economic calendar:

Today is a US holiday. In the Eurozone, there will be a meeting of the Eurogroup.