With the inauguration of US President Joe Biden, the US dollar gained some support and gains against the rest of the other major currencies. The EUR/USD fell to the support level at 1.2076 before stabilizing around the 1.2115 level at the beginning of trading on Thursday. The performance came after achieving gains at the 1.2185 resistance level.

Today, European Central Bank President Christine Lagarde will chair a press conference at 13:30, less than an hour after the monetary policy decision is revealed in the January meeting.

Commenting on the performance, Shehab Galen, Head of Forex Strategy at Credit Suisse, said: “Euro levels are not high enough to warrant any direct interest, especially given the recent downturn, and we believe ECB Governor Lagarde will take the opportunity to signal a strong intention to support debt creation."

The EUR's losses yesterday were not only due to its decline, which spanned a wide range of major currencies, but also because it came on the back of rising equity markets and continued rallies in commodity currencies. The EUR/USD pair has traditionally moved in full swing with stocks and commodity currencies since early last year, so their recent deviation from this pattern has been unusual and may have roots in investor concern about what ECB President Christine Lagarde might say today.

With the European Central Bank’s Governing Council allocating a total of €1.85 trillion from the newly created euro to buy government bonds in the Eurozone as part of the quantitative easing program to counter the effects of the epidemic, which was already reinforced last month, the stronger expectations are that the bank today will not make any surprises. But with yesterday's data from Eurostat showing that inflation remained close to zero in December and core price growth stuck at -0.2%, the lost inflation pressures in Europe are likely to be at the top of Lagarde's concerns.

The continued weakness in inflation could mean that the euro will be criticized for its role in lowering consumer prices, although analysts doubt that the language used will be much different from the one actually used. As a higher euro reduces the cost of imported goods and services, and thus can also reduce consumer price inflation, the European Central Bank and its staff bear the responsibility for the boost. Eurozone policymakers are empowered to offer inflation “close to 2% but less than 2%” in the medium term, but they have largely failed to achieve this target for a few years, and that is why the European Central Bank was the first in a growing number of global central banks to complain about currency strength.

Technical analysis of the pair:

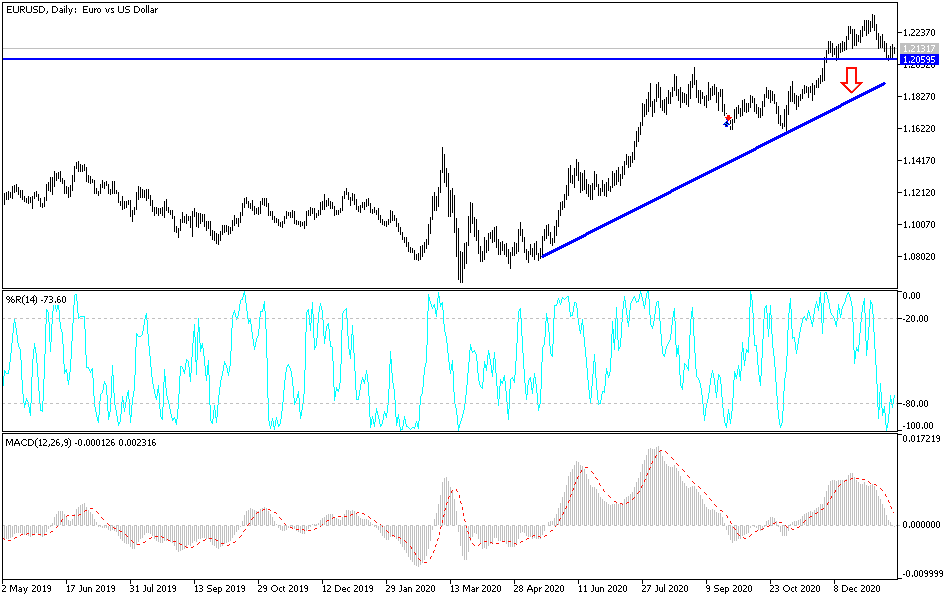

On the daily chart, the EUR/USD currency pair has formed a bearish channel since the second week of 2021 trading. The bearish outlook will be strengthened in the event that selling increases and the 1.2000 psychological support is breached. The pair will not become bullish without settling above the 1.2300 resistance. The anticipated stimulus efforts from the United States and the Eurozone may weaken the US dollar in the coming months. At the same time, interest in it as a safe haven may increase if efforts to contain COVID-19 spiral out of control.

Today's economic calendar:

Focus will be on the announcement of the monetary policy of the European Central Bank and the statements of Governor Lagarde. During the American session, the number of weekly unemployment claims will be announced, and a strong reaction might occur if it is more than one million claims. This is in addition to the Philadelphia Industrial Index reading, building permits, and US housing numbers. Then, there will be the consumer confidence reading in the Eurozone.