Strong moves in the EUR/USD pair are expected as markets and investors await monetary policy decisions by the US Federal Reserve. The COVID-19 pandemic continues to negatively affect all sectors of the US economy, which worries the job market. Since the start of trading this week, the EUR/USD has been stable between the 1.2107 support level and the 1.2189 level, and is stabilizing around the 1.2166 level as of this writing, awaiting a reaction to the Fed's decision.

The results of the FOMC meeting will be announced today, and since the bank changes its monetary policy settings or changes the direction regarding where monetary policy may go in the future, it is a major drive of the Forex market. Expectations for a change in the bank’s policy are low, but the messages sent by Chairman Jerome Powell and his team could be important to the markets to determine the future course.

“We can't see a reason why the Fed has spoiled risk sentiment this week,” says Stephen Gallo, Forex analyst at BMO Capital Markets. Gallo believes that the FOMC event should prove to be supportive of the EUR/USD exchange rate as a result. However, BMO Capital tells clients that they believe the FOMC result has already been widely priced in the Forex market, which means strong major currency moves are unlikely.

“In the EUR/USD, we prefer to continue waiting for downturns before adding new long EUR positions, as the 1.2050/1.2100 range last week proved to be a strong support in the near term,” Gallo added.

At the same time, Ibrahim Rahbari, Head of Global Analysis at CitiFX, expects the Fed to repeat and reinforce its current message of pessimism: lower rates and generous quantitative easing measures for a longer period. He also says that this remains important given the recent rapprochement discussions and other global central banks' considerations of policy adjustment.

Prior to the meeting, the dollar had rallied and stock markets were showing tension as expectations that the Fed would withdraw support were largely driven by rising inflation expectations. This shift in market rates has been reflected in higher yields that are paid out at different periods of US government debt, a development that increases the overall cost of borrowing in the economy and thus creates headwinds to economic growth.

But most analysts say the Fed will want to avoid causing unnecessary pressure in the market at this point and will confirm that it remains committed to a supportive stance. Accordingly, CitiFX does not expect any changes in policy or messaging at this meeting: “Now is not the right time,” as Chairman Powell put it. As such, CitiFX tells clients that it is still expecting a bearish outlook on the USD and sees scope to re-engage in the USD sell-off.

While some argue that the FOMC is supporting the EUR, we reported yesterday that analysts at TD Securities are expecting a decline in the price of the EUR/USD this week. Accordingly, TD Securities is looking to sell the euro and buy the dollar in their trade for this week, based on the view that the currency market is at a crossroads.

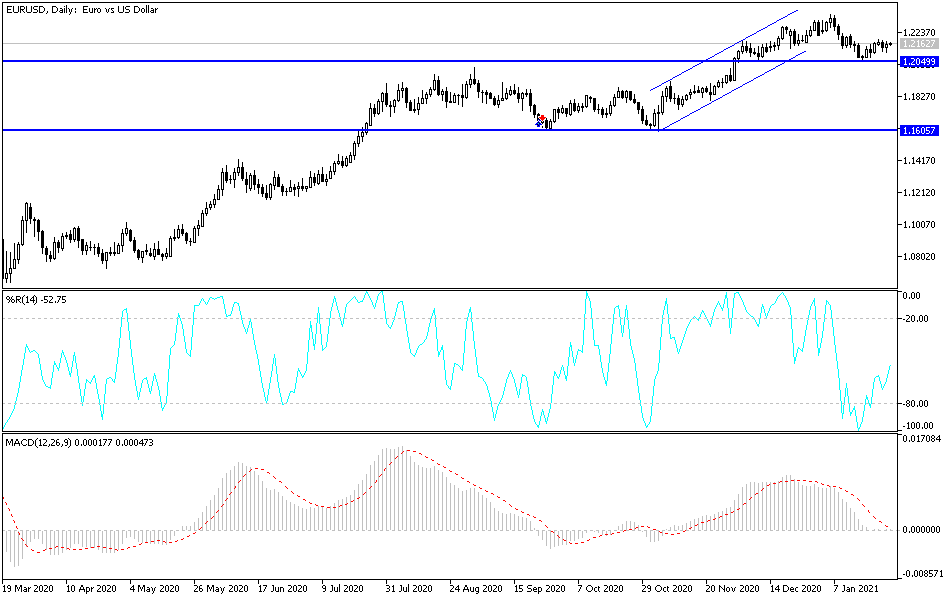

Technical analysis of the pair:

On the daily chart, the EUR/USD is trying to compensate for its recent losses which reached the 1.2053 support by taking advantage of the buy-on-the-dips trend, as optimism still prevails in the markets. Therefore, the support levels of 1.2065 and 1.1990 may be the most important buying levels. On the upside, the bulls need a fresh breakout of the 1.2300 resistance to return to assert control over performance.

Today's economic calendar:

Today will see the announcement of the GFK reading in Germany, then the US durable goods orders, ending with the US Federal Reserve’s announcement of its monetary policy and the statements of its governor, Jerome Powell.