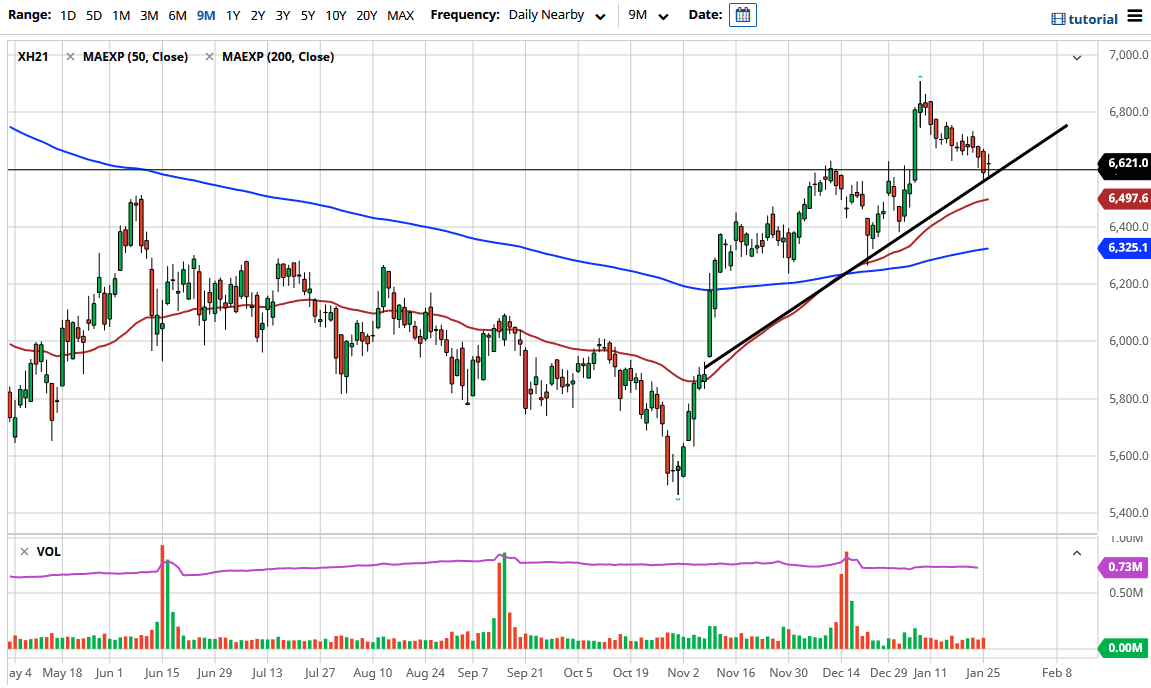

The FTSE 100 fluctuated during the trading session on Tuesday, as we continue to bounce around the 6600 level. Notice that there is a trend line on the chart right where we have bounced from the last couple of days in a row. Further adding to the potential upward pressure is the fact that the 50-day EMA sits slightly below there as well. In other words, there are multiple reasons to think that there might be buyers underneath there, so I do believe that a break above the top of the range for the Monday and Tuesday candlesticks could offer a nice buying opportunity in an index that a lot of people are running towards due to the fact that the United Kingdom is beyond the Brexit now.

This is not to say that it is all rainbows and puppy dogs, but at the end of the day the economy should be getting better over the longer term. There are multiple lockdowns in the UK, so obviously it will lag several other major economies, but there is also a lot of value to be found in this index. I think that we are in the midst of trying to find the footing for a nice uptrending channel, and we are at the bottom of it. More often than not, this is the type of set up that you look back at later and realize that it was “so obvious.” (Here is a little hint: it is never obvious while it is being presented.)

If we do break down below here, then I will look to “reset the bullish thesis” closer to the 6500 level. After that, I will look at the 6400 level with the 200-day EMA approaching it quite rapidly. I do not really have an interest in shorting the FTSE 100, but I might be able to be convinced to do so if something drastic happens from an economic lockdown standpoint in the UK. It is simply much easier to buy stocks on dips than it is to try to short an index. While the FTSE 100 is not as manipulated as the US indices, clearly there will be more of a bullish bias over the longer term anyway.