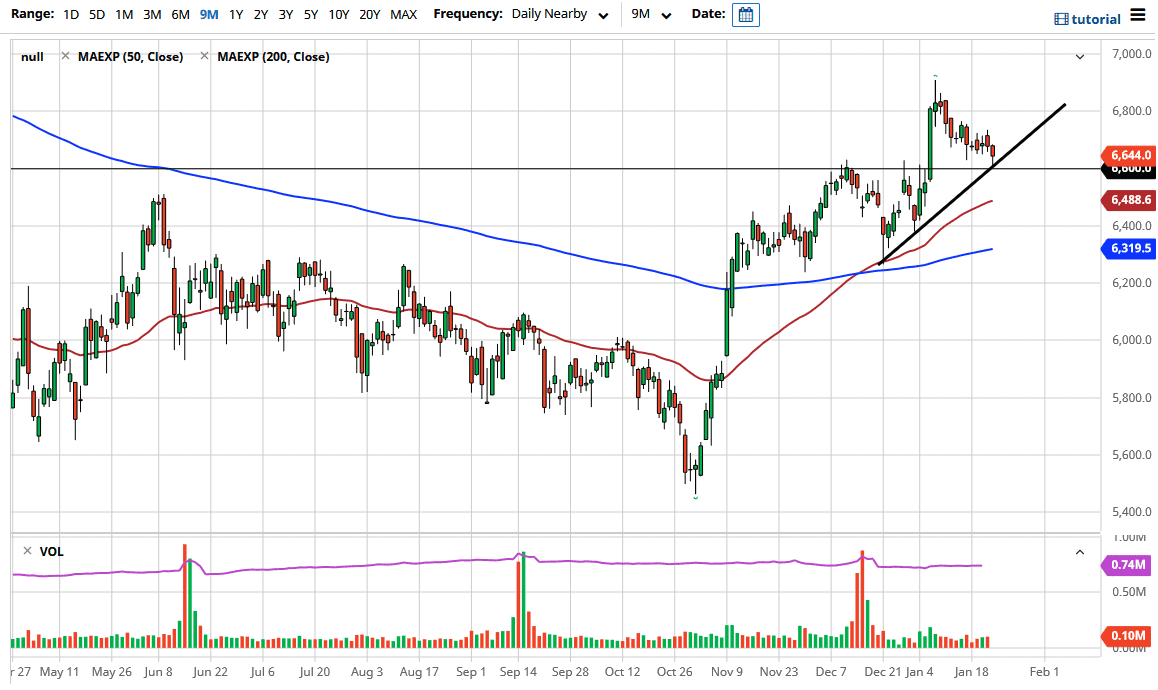

The FTSE 100 initially fell during the trading session on Friday but found enough support at a confluence of interest that the market turned around to form a hammer. The hammer is a bullish sign, and we will probably see the FTSE try to rally based upon a simple technical bounce. As you can see, there is a trend line that slices right through the psychologically and structurally important 6600 level. In fact, the 6600 level had been resistance, so market memory dictates that it should go higher over the longer term.

The 6600 level has been important more than once, so I think that if we break down below there, it is likely that the market could go down to the 50-day EMA, which would be a very negative sign. This is a market that should continue to find buyers on dips in general, due to the fact that traders around the world continue to flock into risk assets, like stocks in the FTSE 100. The market continues to attract inflows due to the fact that we are now beyond Brexit, and as a result, the economy in the United Kingdom can start to rebuild.

Now that we have a bit of certainty, we have seen a bit of a bounce. Furthermore, the market will eventually continue to reach towards the 6800 level, possibly even the 7000 level based upon the technical indicators. Beyond that, traders are starting to look beyond the idea of lockdowns in the United Kingdom, as markets tend to price in the future. The idea is that eventually the United Kingdom will open up and that commerce will resume. The market is likely to continue to see a lot of volatility and choppiness, but it is probably safe to say that most stock markets cannot be shorted, the FTSE 100 will be no different than any other. I do not have any interest in shorting this market, because I think that a lot of longer-term value hunters are starting to get involved here. If the British pound continues to rise, it could put a little bit of stagnation in this market, but if it does so in a very steady manner, it is likely that it will be slowly rising.