The FTSE 100 fell initially during the trading session on Thursday but found enough support at the 6400 level to turn around to show signs of strength. That being the case, it looks like the market will probably continue to see value hunters coming back into the market. It is worth noting that the Americans also ended up causing their indices to bounce quite significantly as well, so this does bode well for more of a “risk on” type of session on Friday for a little bit of follow-through.

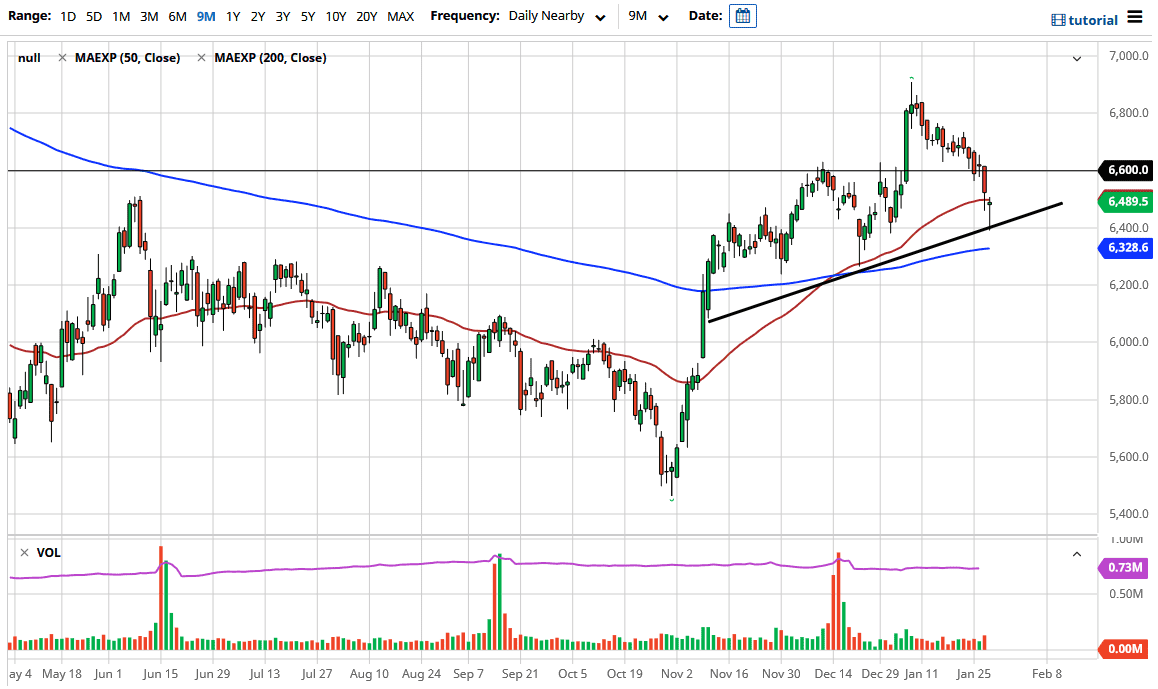

From a technical analysis standpoint, we closed just below the 50 day EMA, but have also bounced from not only a large, round, psychologically significant figure, but also a potential trend line. The market has been rallying for some time and of course that makes quite a bit of sense considering that there is the so-called “reflation trade” out there and markets tend to look into the future in order to speculate on strength. The United Kingdom has been locked down for a while, and it seems to me as if the market is likely to continue to see traders trying to bet on the idea of the vaccine change everything. Whether you believe the market re-flights again or not, that does not matter because that is the narrative that the market is following right now.

To the upside, the 6600 level would be an area of resistance, and then the 6800 level. It might be a bit difficult to get up there straightaway, but it looks like we could get a little bit of a grind higher based upon the structure of the market. On the other hand, if we were to break down below the 6400 level it would of course be somewhat negative. That could open up the door down to the 200 day EMA, which as a general rule does attract a certain amount of attention anyway. All things being equal, I do think that this is only a matter of time before we see buyers jumping into this market, as there seems to be a lot of value to be found in the United Kingdom overall. The UK economy was priced for Armageddon, and now the Brexit is behind us I do think that it is only a matter of time before money flows back into London.