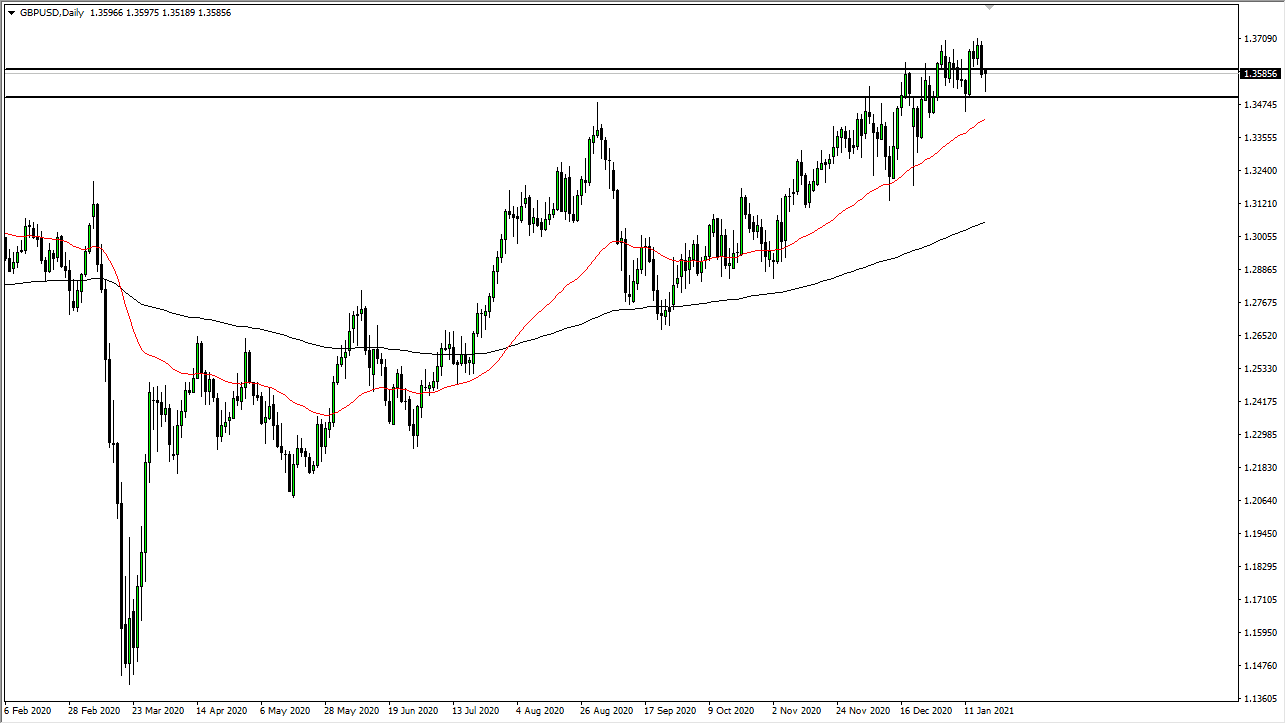

The British pound fell initially during the trading session to reach down towards the 1.35 handle. This is an area that is very significant due to the fact that the market loves these large, round, psychologically important figures. The market bouncing from there should not be a major surprise, because we have seen buyers in that general vicinity previously anyway. The fact that we ended up forming a hammer is a bullish sign as well, as it goes with the longer-term uptrend. However, it is also worth noting that the 1.37 level so far has been a bit of a brick wall, so I think that we still have quite a bit of work ahead.

If we can break down below the 1.35 handle, the market then will test the 50-day EMA just below, which is a technical indicator that a lot of people watch. Furthermore, there is a “buy on the dips” mentality still out there, so will have to wait and see what happens next. The market clearly prefers to go to the upside, and when you look at the British pound from a historical standpoint, we are most certainly cheap at this level. This is not to say that we cannot drop from here, just that over the long term I suspect that the British pound is going to continue to go higher.

At this juncture, what we have is a market that is a little overextended, and we may get a little bit of choppiness in the short term. The 1.3750 level has been resistance in the past, and if we can break above there, then I believe the British pound will go looking towards 1.40 level, which is my longer-term target. To the downside, breaking below the 50-day EMA opens up a bit more support-searching, perhaps down to the 1.3250 level. If we break that level, then I think the whole thing falls apart; but right now, that does not seem to be very likely based upon recent action. The candlestick from the Monday session was worth paying attention to, but I would not be surprised at all to see a little bit of a pullback despite the candlestick due to the fact that it was holiday in the United States and that of course brought down liquidity.