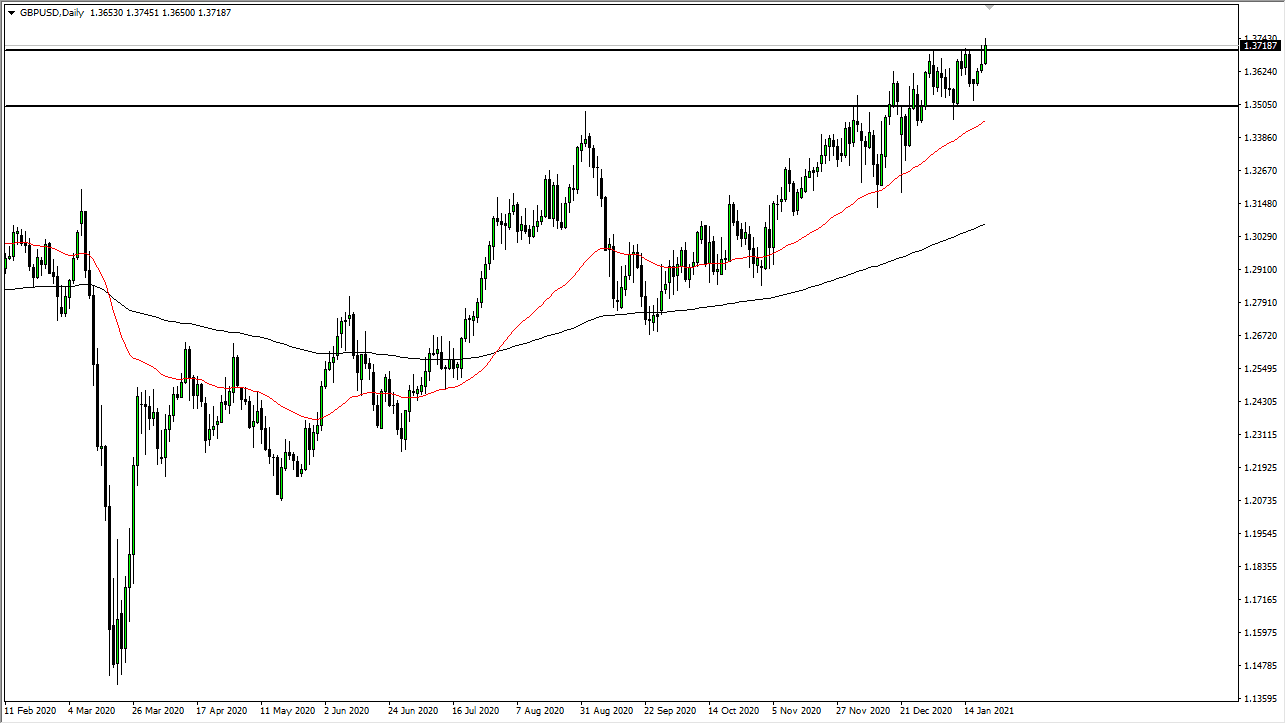

The British pound has broken above the 1.37 level during the trading session on Thursday as it looks like we are trying to continue to go higher. At this point, the 1.3750 level is an area that has been important more than once, and if we can break above there it opens up the possibility of the market going much higher, perhaps reaching towards 1.40 level. That being said, the market is likely to continue to see buyers given enough time, but I think there are a lot of questions right now about the stimulus, as Republicans in the Senate are now starting to balk at the idea. This of course could have a little bit of strength coming back into the greenback, but I think this is a market that is going to continue to be noisy.

If we do not get enough stimulus, that could completely nullify the idea of the US dollar been eviscerated. Ultimately, I think that the market is likely to see a lot of volatility, but at this point we will have to continue to pay attention to is the fact that the occasional political remark could send the market all over the place. Furthermore, we have to pay attention to political comments coming out of the United Kingdom as well, as coronavirus lockdowns continue to be a major problem. However, if the numbers continue to drop, that should be good for the British pound longer term.

In other words, we have a major “push/pull” dynamic going on at the moment, so I think that this is a market that will continue to see buyers on dips in general, but if we were to break down below the 1.35 level, which is also being reinforced by the 50 day EMA, then the market could go lower. In the meantime, I do think that we are going to see a lot of noise and therefore it is difficult to hang onto the trade for anything more than a quick scalp, and that is essentially what we have seen over the last couple of weeks. Ultimately, the market is in an uptrend, but we continue to see a lot of overall bullish attitude, so I have to follow the momentum, but I also recognize is going to take a certain amount of momentum building in order to continue the longer-term move.