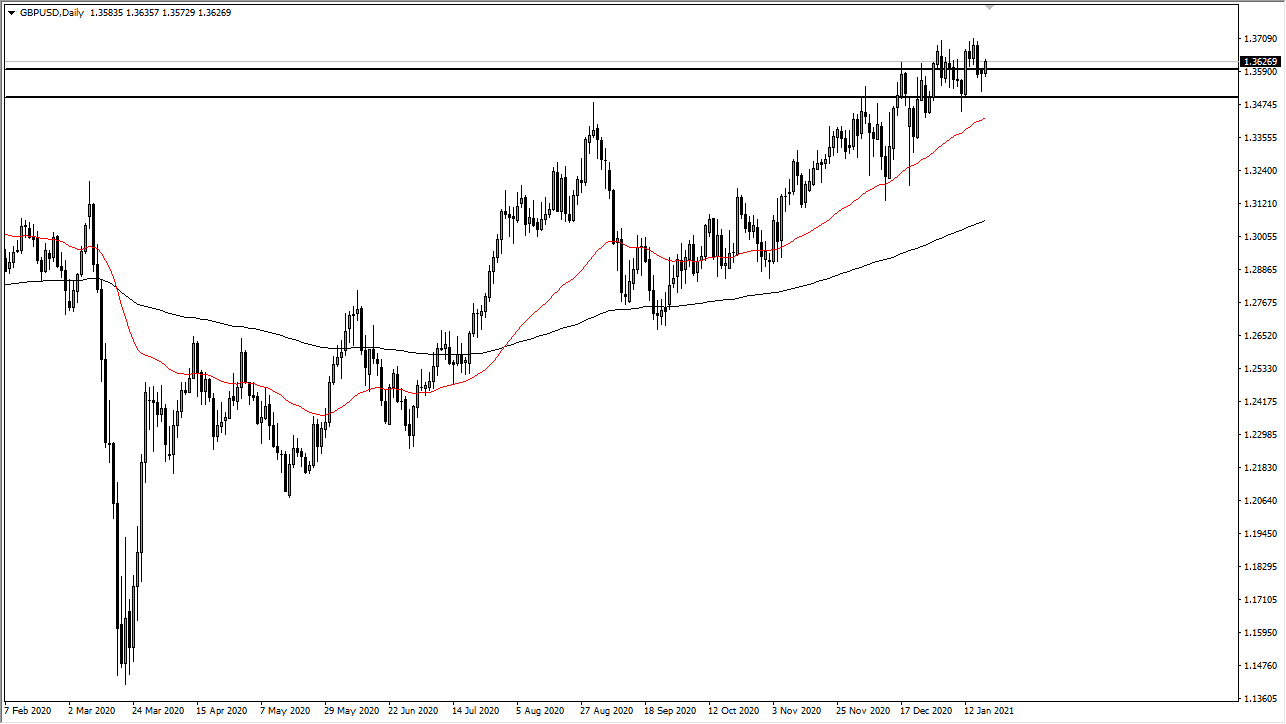

The British pound rallied a bit during the trading session on Tuesday, as we had broken above the top of the hammer from the previous session. That is a bullish sign, but we are very tight at the moment and perhaps even struggling to build a significant amount of momentum. If we can break above the 1.3750 level, then it is likely that the market could go higher. At that point, the market is likely to go looking towards 1.40 level, which is a large, round, psychologically significant figure.

To the downside, if we break down below the 1.35 handle, that would be a very negative sign, but I also think that there are plenty of buyers just underneath. The 50-day EMA is starting to come into the picture, and that is something that is worth watching. This is a market that will eventually find reasons to go higher, but in the meantime, we may have a bit of “wood to chop.” In other words, we need to work off some of the excess froth. After all, most of what is driving this pair higher at the moment is the fact that the US dollar is being sold off quite drastically, and it had been a bit overdone recently. We could get a little bit of a bounce, and that could send the market looking to pull back a bit over here. Nonetheless, I have no interest in shorting this market, as the uptrend is very much intact, and with the reflation trade and stimulus coming out the United States, that should continue to work against the greenback in general. The British pound also is at a very interesting point, as we have just exited the Brexit negotiations, so we at least have a general idea of how things are going to play out in the United Kingdom, something that people have desperately been looking for clarity on. At this point, it is a matter of trying to get back to the historical norms, which means we will go higher over the longer term. Short-term pullbacks should be thought of as potential buying opportunities.