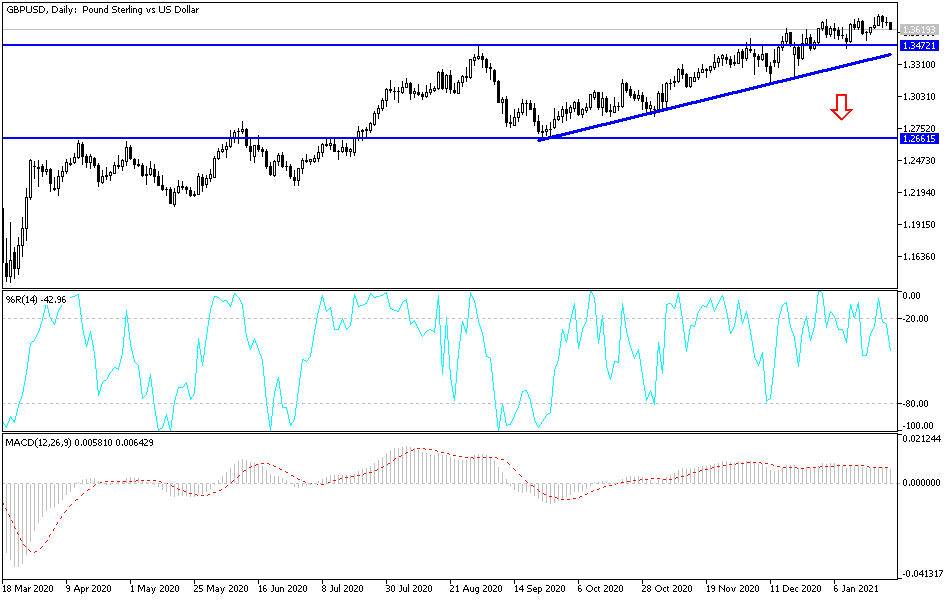

The British pound initially tried to rally during the trading session on Monday but gave back the gains close to the 1.37 level yet again. The resulting candlestick was a shooting star, but I do not think that it is a major problem. To the downside, the 1.35 level underneath will be massive support, perhaps extending to the 1.36 level. This is a pair that has been supported for some time, and dips will continue to be bought into, not only due to the fact that there is a lot of stimulus out there, but the 1.35 level is a large, round, psychologically significant figure that is now backed up by the 50-day EMA.

The alternate scenario is that we break above the 1.3750 level, and that should open up a move towards 1.40 level. The 1.3750 level has been massive resistance previously, so I think that it is only a matter of time before we break out, but it may take multiple attempts. The US dollar is being decimated by the idea of stimulus, but stimulus may not be the only thing that people are paying attention to. Keep in mind that the British pound is undervalued from a longer-term historical standpoint, so we will eventually go higher as people start to look at the UK economy opening back up.

After all, the British pound has been priced for Armageddon, and now it appears that the previous reports of the death of the United Kingdom were a little over-exaggerated, and people will start to look at the possibility of making money there again. To the downside, there should be plenty of interest in the market underneath as a longer-term “value play.” However, if we were to break down below the 1.34 level, then it is possible that we might go looking towards the 200-day EMA, which is closer to the 1.31 handle. Either way, buyers will eventually come back, so a longer-term short is all but impossible at this point. Even though we may have a bit of an overbought condition, we are not exactly over-extended, which is a subtle but important difference.