The British pound initially tried to rally during the trading session on Friday, but after the non-farm payroll numbers came out, fell in a “risk-off” type of move. Perhaps more importantly, we have seen the 10-year yields in the United States rise, which can drive up demand for greenbacks, at least in the short term. Long term, it is a completely different story still, as the British pound is essentially “historically cheap” at this point, and will continue to attract a certain amount of value hunting.

It is obvious that the UK economy is going to suffer from the lockdown, but questions remain about Brexit ramifications more than anything else. The idea is that it may be difficult for a while, but eventually normalcy will come back. The United Kingdom is also in the process of innoculating its citizens, so that should help open up the economy eventually as well. On the other side of the equation, you have the United States dollar. The US is about to do massive amounts of stimulus, which should continue to bring down the value of the currency. If it does, that will provide a bit of natural support for this pair, and it is likely that the British pound will continue to the upside.

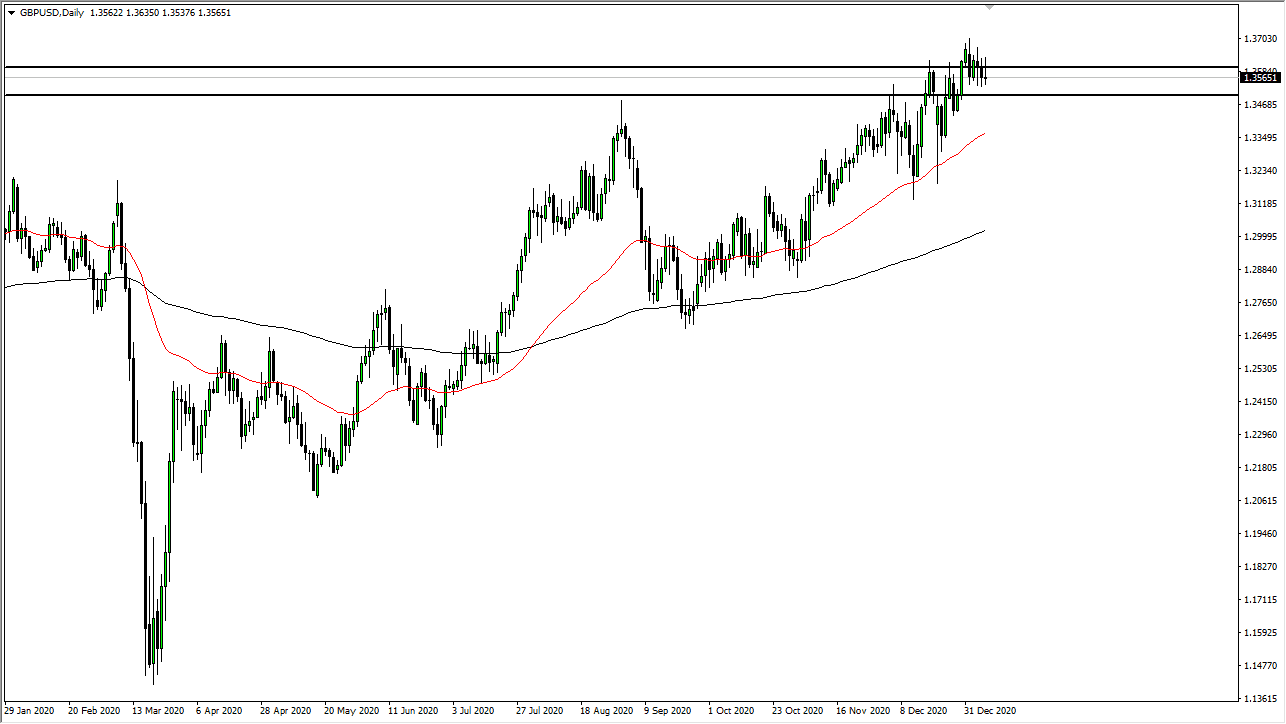

I believe that there is support below at the 1.35 handle, and most certainly at the 50-day EMA. The 50-day EMA is currently sitting at the 1.3350 area and sloping quite nicely to the upside. In other words, I think there are plenty of buyers underneath that are willing to get involved. I believe at this point, it is only a matter of time before value hunters come back in, so I have no interest in shorting this market, despite the fact that it does look like it is ready to drop a bit. Notice how choppy it is underneath, which means that there are plenty of areas in which buyers have been involved and are likely to get involved again. Unless we get a significant breakdown scenario in risk appetite, this is a pair that will continue to go higher given enough time. I simply look for value underneath.