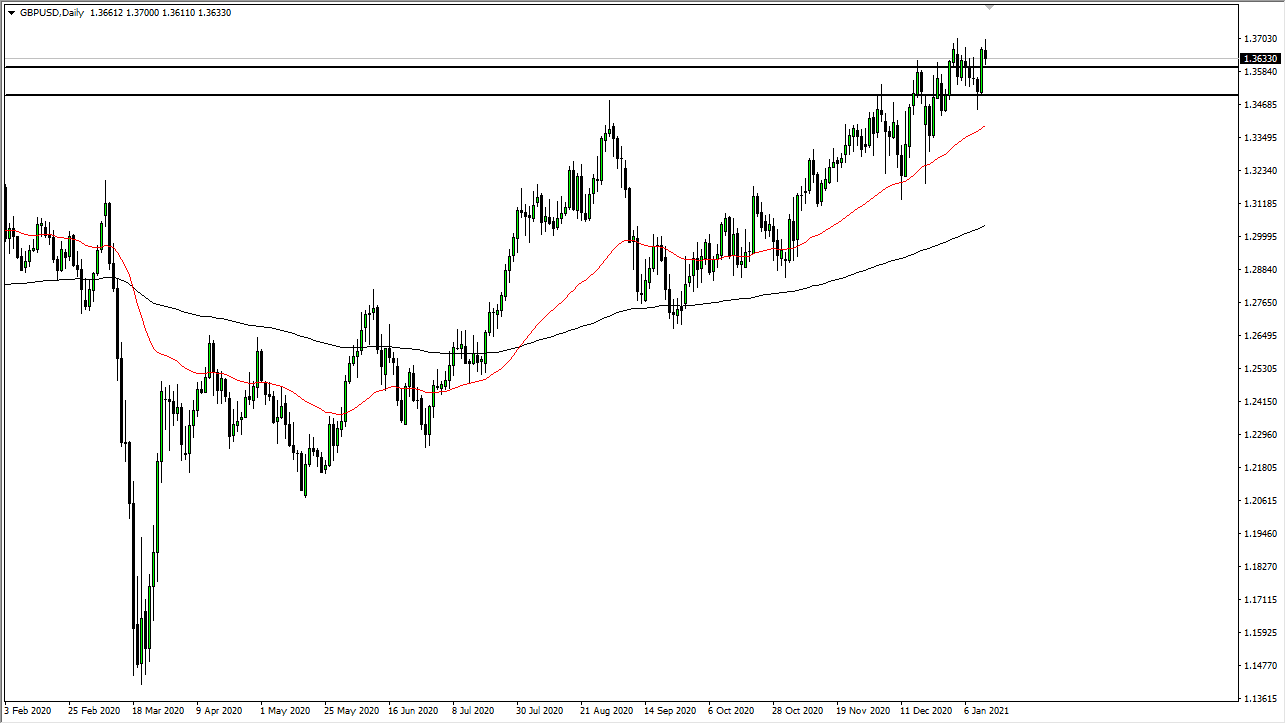

The British pound initially tried to rally during the trading session on Wednesday, but gave back the gains to reach towards the 1.36 level. While I do not necessarily think this is a negative sign, it does suggest that we are going to see a bit of a pullback. That makes sense, considering that the market had such a strong session during the day on Tuesday, and we may have had trouble breaking through what would be significant resistance above after all of that energy was expended.

Because of this, a pullback will probably get bought into, as the 1.35 level should be support. Furthermore, the 50-day EMA underneath is sloping higher and reaching towards that level, so from a technical analysis standpoint, it is likely that we will continue to see a lot of people trying to pick up dips, especially as the US dollar seems to be on its back foot for the longer term. With stimulus coming out of the woodwork in America, it is very likely that we will continue to see dollar selling. It is not necessarily that the British pound is the favorite currency around the world; just that it is not the US dollar, so by a certain amount of logic, it should go higher.

Keep in mind that the British pound is undervalued from a historical standpoint, and that is something that people will be paying attention to. The overall action has been very bullish, but given enough time, it is only logical that we could go looking towards the 1.3750 level, and then the 1.40 level after that. To the downside, if we broke down below the 50 day EMA we could go looking towards 1.3250 level, perhaps even the 200 day EMA. In fact, it is not until we break down below the 200-day EMA that I would consider shorting this pair, and by then there would probably be a fundamental reason to become overly concerned about the pound, and perhaps we could see a massive amount of “risk off” type of attitude around the world as people run towards the US dollar. Unless that happens, I find it very difficult to imagine a scenario in which this market breaks down significantly.