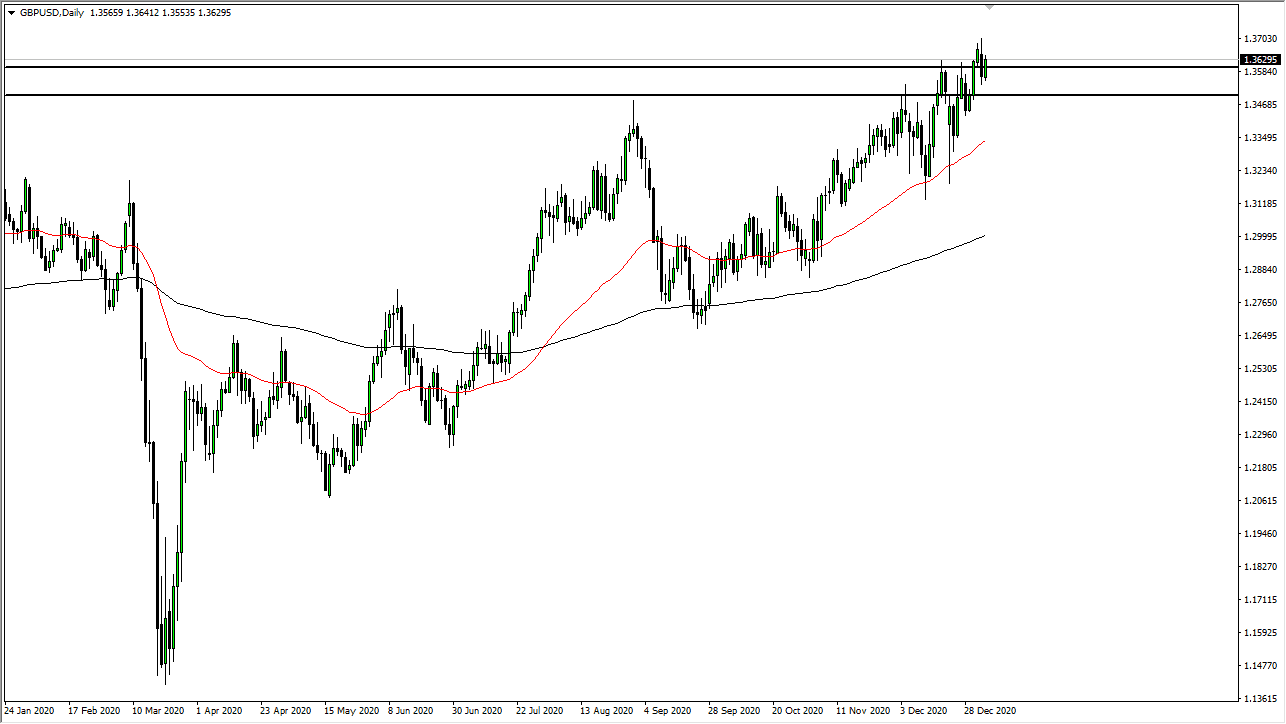

The British pound rallied a bit during the trading session on Tuesday to break above the 1.36 handle. That is a major sign of strength, considering just how bad things had been previously. The area between the 1.36 level and the 1.35 level is a major area to pay attention to, as it was major resistance previously and a certain amount of “market memory” could come back into play.

Furthermore, if we break down below the 1.35 level, there is plenty of support underneath at the 50-day EMA, which is roughly 1.3350 currently. There will be plenty of buyers to come back into the market at that area as we have seen multiple times previously, and what is most important here is the fact that we did not melt down after Boris Johnson announced that the United Kingdom is locking itself back down. It is worth noting that although the British pound should have melted down, we have already recaptured all of those losses, which tells me just how resilient this pair is going to be. It also suggests just how much US dollar weakness is driving the market. Pullbacks at this point in time should be nice buying opportunities. If locking the economy down even further will not break down the pair, then there is not much else that will.

To the upside, the 1.3750 level would be a target, and if we can break above there, we will more than likely see this market reach towards the 1.40 level above. The British pound is still relatively cheap from an historical standpoint, and I think that will start to come back into play. It is only a matter of time before dips get bought, and people wiill hang on to the move for a longer-term play. The 1.50 level I believe is the ultimate target, perhaps even higher than that. If we get a massive reflation trade out of the United States and if we get some type of global recovery, that will continue to be the overall attitude and this market would simply grind higher right along with the rest of the other currency pairs.