Bearish case

Short the GBP/USD when it hits 1.3650, the upper side of the bearish flag.

Put a take-profit at 1.3540, yesterday’s low.

Add a stop-loss at 1.3700.

Bullish case

Buy the GBP/USD if it moves above 1.3650.

Put a take-profit at 1.3700 and a stop loss at 1.3540.

The GBP/USD pair is under pressure as the number of coronavirus cases continue to rise, forcing the government to unveil new lockdown measures. As of 04:05 GMT, the pair is trading at 1.3600, which is lower than this week’s high of 1.3705.

UK New Lockdown Measures

Last week, the GBP/USD was in high spirits after the UK and the European Union reached a deal to avert a no-deal Brexit. This week, the focus has turned to the overall outlook of the UK economy as the number of coronavirus cases in the country has risen.

Yesterday, the country recorded more than 58,000 new cases, bringing the total number to more than 2.71 million. The daily increase was the highest figure since April of last year and is a sign that the situation is getting worse. Deaths have risen to more than 75,300.

As a response, the Boris Johnson administration announced new lockdown measures that will have a negative impact on the economy. The new measures will see primary and secondary schools closed. Many businesses deemed as being non-essential will also close, while the number of private gatherings will be scaled back.

The latest directive came as the country is addressing the new variant of the virus that is spreading 70% faster than the original one. Also, the country is continuing its vaccination plans.

Therefore, as the situation changes, the GBP/USD will likely react mildly to the vital UK Service PMI data that will come out later today. Economists expect the data to show that the Service PMI improved to 49.9 in December from 47.6. They also see the Composite PMI rising to 50.7.

The GBP/USD will also react to the final outcome of the Georgia Senate seat. While the two Republicans are leading, the situation could change as more votes come in.

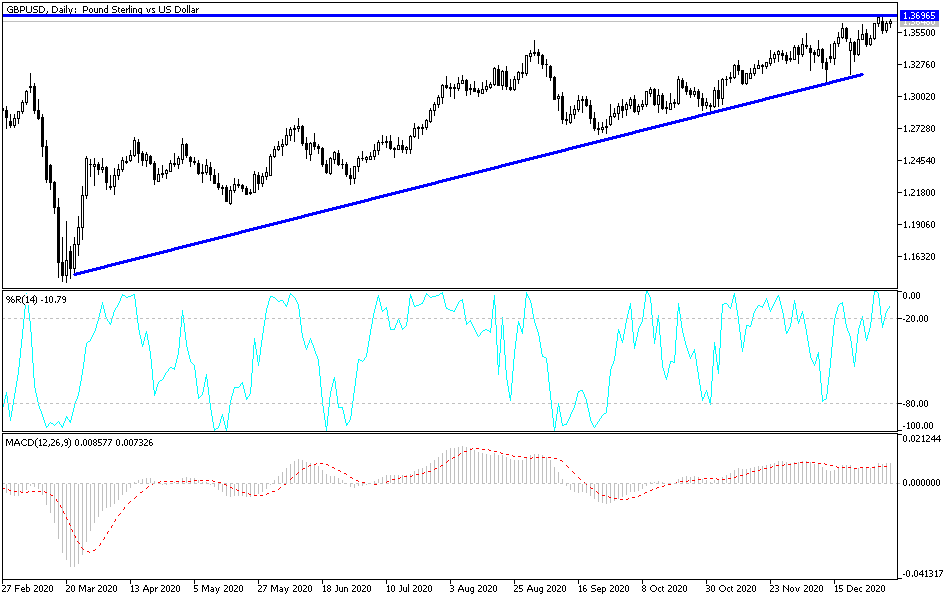

GBP/USD Technical Analysis

The GBP/USD pair is trading at 1.3600, which is an important psychological level. On the three-hour chart, the price has formed a bearish flag pattern that is shown in blue. Also, it is between the middle and the lower line of the Bollinger Bands.

Therefore, I suspect that the pair will break out lower as bears target the next support at 1.3540. This is the lowest level yesterday and the lower side of the Bollinger Bands.