Bullish signal

Buy the GBP/USD because of the strong uptrend.

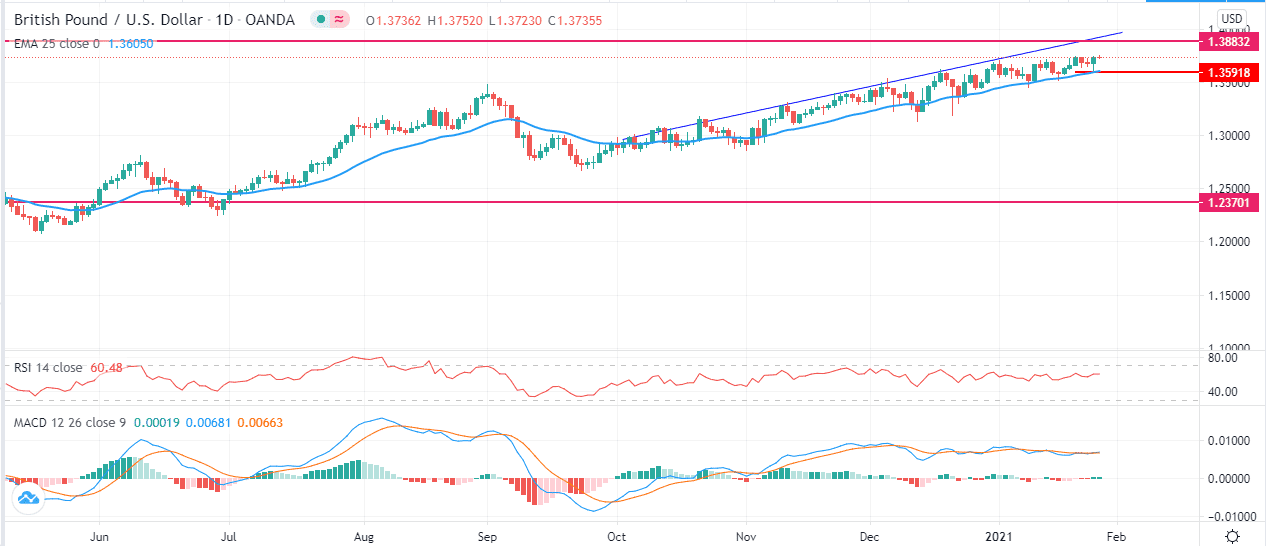

Have a take-profit at 1.3882 (the upper side of the channel).

Add a stop loss at 1.3590 (25-day EMA).

Timeline: 1-3 weeks

Bearish signal

Set a sell-stop at 1.3590 and a take-profit at 1.3500.

Add a stop loss at 1.3650.

The GBP/USD is holding steady after the relatively strong UK employment numbers that were released yesterday. The pair is trading at 1.3732, which is the highest it has been since April 2018.

Negative Rates at Bay?

Last Friday, the Office of National Statistics (ONS) published relatively weak December retail sales numbers. A few days before that the bureau had released relatively upbeat inflation numbers.

Yesterday, it released better-than-expected employment numbers. In total, the unemployment rate rose from 4.9% to 5.0%, which was better than the expected 5.1%. Also, wages increased faster than analysts were expecting.

Therefore, the GBP/USD rose because traders now believe that the Bank of England (BOE) will not have the urgency to move rates to the negative zone.

However, the UK economy is not out of the woods yet. Public debt has risen and economists believe that the unemployment rate will rise to between 6% and 7% in the next few months when the furlough program ends.

Focus on the US

Today, there will be no major economic data from the UK. Instead, focus will be in the United States where the Bureau of Statistics will publish the core durable goods orders numbers in the afternoon session. In general, economists expect the data to show that durable goods orders rose by less than 1% in December.

The GBP/USD will also react to the outcome of the two-day Federal Open Market Committee (FOMC) interest rate decision. The bank will leave its interest rate unchanged at the range of 0.0% and 0.25%. It will also commit to continue its expansionary asset purchase program. Still, analysts will look at any change in the bank’s statement and dot plot. The GBP/USD will see substantial moves if the bank changes its tone on the future outlook.

GBP/USD Technical Outlook

The GBP/USD pair has been on a strong upward trend in the past few months. On the daily chart, it has formed a blue ascending channel. It is now slightly below the upper side of the channel. Also, it is being supported by the 25-day moving average and oscillators like the RSI and the MACD. Therefore, in the near term, the pair will likely continue rising as bulls target the upper side of the channel at 1.3883. This prediction will be invalidated if the price falls below the 25-day EMA level at 1.3590.