Bull case

Buy the GBP/USD and have a take profit at 1.3700.

The take-profit is the previous double-top zone and is also an important psychological level.

Have a stop loss at 1.3600.

Bear case

Set a sell-stop trade at 1.3635.

Add a take-profit at 1.3600 and a stop loss at 1.3665.

The GBP/USD is up for the second straight day ahead of important UK inflation data and the inauguration of Joe Biden. The pair has jumped by almost 1% from its Monday low of 1.3520.

Weaker US Dollar

The GBP/USD is rising as the US dollar continues to decline. The US Dollar Index is trading at $90.35, which is substantially lower than last week’s high of $90.9. This performance is possibly due to the incoming US president who has vowed to provide trillions of dollars worth of stimulus to help support the economy.

Last week, he unveiled a $1.9 trillion stimulus proposal that included funds for states and $1,400 stimulus checks. And in her confirmation hearings yesterday, Janet Yellen, the incoming Treasury Secretary, said that the US needed to “act big” to prevent a long slow down. Further, Biden has vowed to provide more spending through infrastructure development and clean energy investments. All these have led to a relatively weaker US dollar and the strength of the GBP/USD.

UK Inflation Data Ahead

The GBP/USD is also rising ahead of the important UK inflation data that will come out at 07:00 GMT. Economists polled by Bloomberg expect the data to show that the headline CPI rose from -0.1% in November to 0.2% in December. That will lead to an annualised increase of 0.5%.

Similarly, they expect the core CPI to increase to 0.2% from -0.1% and the year-on-year CPI to increase to 1.3%. Other vital economic numbers that will come out at the producer price index (PPI) and the retail price index.

These numbers will be released a week after Andrew Bailey warned about the risks of negative interest rates in the UK.

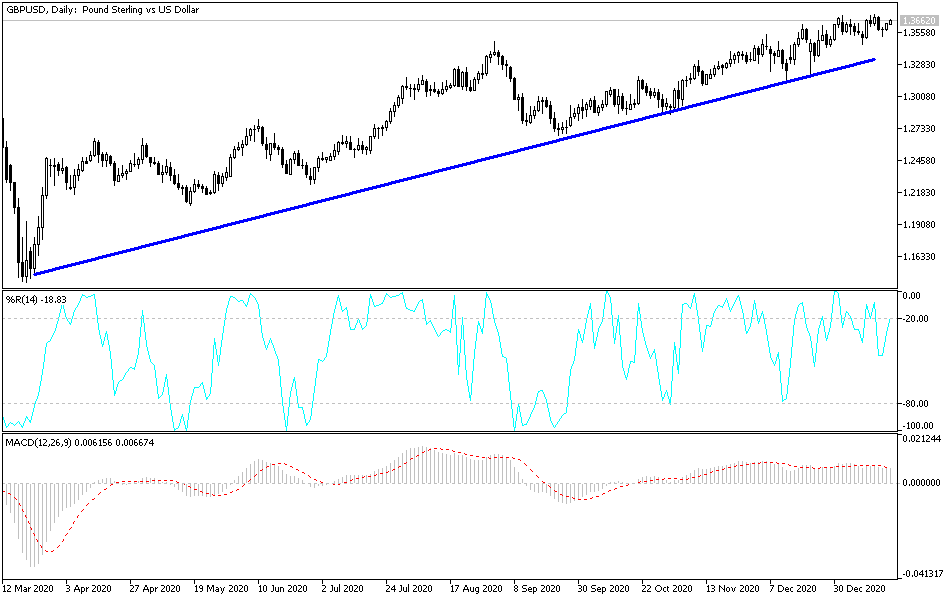

GBP/USD Technical Outlook

On the hourly chart, the GBP/USD pair has been in a strong upward trend and is just 0.35% below the previous double-top at 1.3700. The pair has moved above the 25-period and 15-period exponential moving average. The average directional index (ADX) has also been rising.

Also, it appears to be forming a rising wedge pattern that is shown in black. This sends a signal that further gains could be limited. As such, the pair is likely to continue rising as bulls eye 1.300 before making an eventual pullback.