Bullish case

Buy the GBP/USD because of the bullish momentum.

Target the upper side of the rising channel at 1.3800.

Have a stop loss at 1.3482

Duration: 1-2 weeks.

Bearish case

Short the GBP/USD if it falls to 1.3482.

Target the lower side of the channel at 1.3400.

Have a stop loss at 1.3600.

The GBP/USD bounced back in the overnight session as traders reacted to the relatively hawkish statement by Andrew Bailey. It is trading at 1.3690, which is 1.80% higher than this week’s low of 1.3448.

Andrew Bailey Comments on Negative Rates

The Bank of England (BoE) has been assessing the efficacy of negative interest rates since last year. In a statement on Monday, Silvana Tenreyo, an MPC member, said that the bank should move rates below zero. She argued that such rates would provide substantial stimulus to the economy. Besides, she said that sub-zero rates had worked well in Switzerland, Japan, Sweden and the Eurozone.

However, in a statement at the Scottish Chamber of Commerce, Andrew Bailey said that negative rates were relatively complicated. He cited their impact on the vital banking sector that employs a lot of people in the UK. With negative rates, banks would find it difficult to make a profit. Therefore, the GBP/USD rose because, in theory, negative rates would also hurt the sterling.

Still, there are concerns about the BoE’s other options if the UK economy continues deteriorating. It has already slashed interest rates to zero and launched a massive quantitative easing program.

The GBP/USD also rose because of the weak US dollar. The US Dollar Index declined by 0.15% in the overnight session ahead of an important stimulus speech by Joe Biden and the rising US Treasury yields. In his speech, the incoming president will talk about the size of the upcoming stimulus that could reach $3 trillion. It will likely have more stimulus checks, money for state and local governments and for vaccine distribution.

GBP/USD Technical Outlook

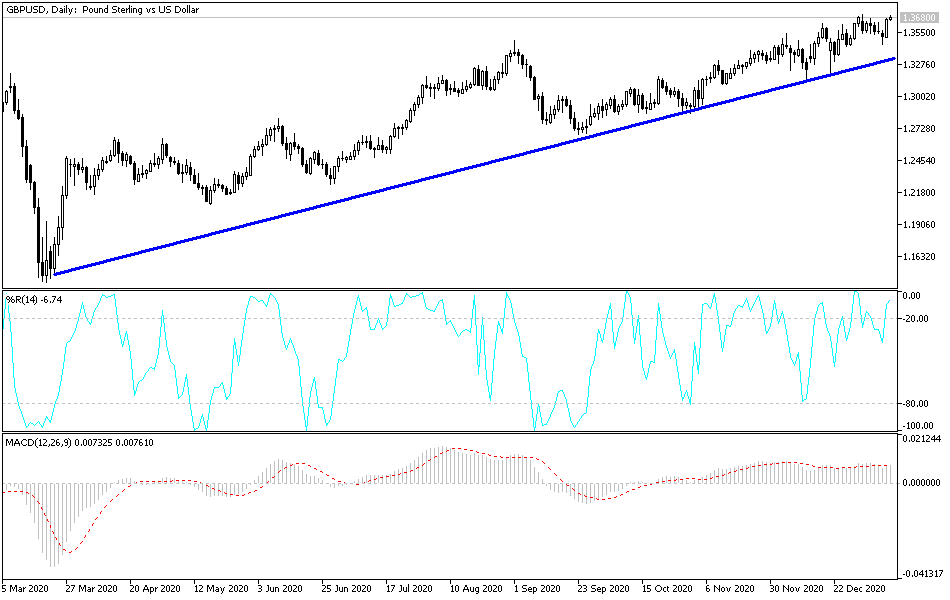

The GBP/USD pair has been on a steady uptrend in the past few weeks. On the daily chart, the pair has formed an ascending channel that connects the lowest and highest levels since September last year.

It has also moved above the 25-day and 50-day weighted moving averages, which is a sign that bulls are in control. Also, the price moved above the important resistance at 1.3482, which was the highest level in September.

Therefore, the pair will possibly continue rising as bulls eye the upper side of the channel at 1.3800 that is about 0.80% above the current price. However, a decline below 1.3482 will invalidate this thesis.