Bullish case

Buy the GBP/USD hoping that the uptrend will continue.

Have a take-profit at last week’s high at 1.3748.

Add a stop loss at the Friday’s low at 1.3635.

Bearish case

Set a sell-stop order at 1.3635, which is the lowest level on Friday.

Add a take-profit at 1.3600, which is along the ascending trendline.

Set a stop-loss at 1.3700.

The GBP/USD is up slightly as concerns about the UK economy remain ahead of the country’s employment numbers. The overall weaker US dollar has also contributed to today’s bounce. It is trading at 1.3702, which is above Friday’s low of 1.3635.

UK Earnings Ahead

The UK economic calendar will be relatively muted this week because most of the important numbers came out last week. For example, on Friday, the Office of National Statistics (ONS) released relatively weak retail sales numbers. The data showed that the overall sales increased by 2.9% while the core retail sales rose by 6.4%. The two figures missed the median estimates of 4.0% and 7.0%, respectively.

In the same week, the ONS published relatively strong inflation data while the association of motor dealers released the December car sales. This week, the most important numbers from the UK will be the average earnings data that will come out tomorrow. Economists expect the data to show that the unemployment rate rose to 5.1% in November while the average earnings ex-bonus rose by 3.1%.

Therefore, the most important catalyst for the GBP/USD will be the first Fed interest rate decision of the year that will come out on Wednesday. Like other central banks that delivered their rates last week, economists expect that the Fed will leave its policy tools intact. This means that it will leave the overall interest rate at 0.25% and its open-ended quantitative easing policy unchanged. The pair will also react to the first reading of the US Q4 GDP data that will come out on Thursday. Analysts expect that the economy rose by 4.0% in the fourth quarter.

GBP/USD Technical Outlook

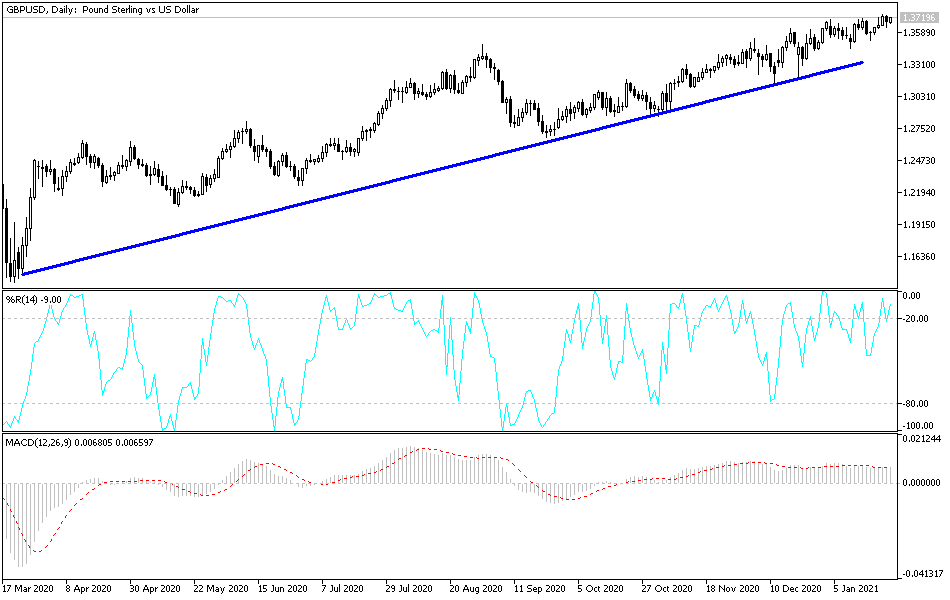

The GBP/USD rose to 1.3702 today, which is slightly above the 25-period and 15-perood exponential moving averages. The price is also a few pips below last week’s high of 1.3748. The upward trend is also being supported by the ascending purple trendline that connects the lowest levels from December.

Therefore, the pair will possibly continue rising so long as the price is above the ascending trendline. As such, the next key level to watch will be last week’s high of 1.3748. A break above this resistance will see the pair target the next psychological level at 1.3760.