Sell-offs pushed the GBP/USD to stabilize around the 1.3634 level as of this writing, after upward momentum at the beginning of this week's trading pushed the pair to the resistance level at 1.3723. The British pound is back to tracking movements in global stock markets. The GBP started the new week's trading with a rise after a bullish session in Asian stocks, but the loss of strength in the London session made the British pound retreat somewhat. The GBP started the new week slightly more stable, rallying along with global stock markets as investors choose to look at some of the near-term concerns over the COVID-19 pandemic and focus on US stimulus measures.

These moves come at a time when the pound has begun to show its connection with investor sentiment now, after Britain's exit from the European Union is no longer a factor as a major driver, and in the coming days, the pound will return to interact with the British economic performance and efforts to contain the coronavirus.

The decline was lower in global stock markets at the end of last week’s trading, amid a noticeable decline in investor sentiment, which in turn seems to have affected the British pound and pushed it down as well. However, sentiment appears to be somewhat more flat going into the last week of January, helped by some of the sterling's exchange rate gains. Market sentiment started positively this week, with most Asian stock markets trading higher. This comes on the heels of the US stock markets reaching new highs last week on the back of expectations that the new Biden administration and the Democratic-controlled Congress will lead to an important new financial stimulus.

Despite the strong start to trading this week, risks to the outlook remain high and further progress in stocks and the British pound is difficult due to the uncertainty over the COVID-19 pandemic. Jim Reed, a Deutsche Bank research strategic analyst, said: “Vaccinations are slower than we expected in all large countries and even in countries that were faster, such as the United Kingdom, the first dose strategy means that full protection will be slower to emerge. It also does not appear to be the case since simply vaccinating the vulnerable would be enough to lift most of the restrictions as I expected. This is partly due to growing concerns about mutations from different parts of the world."

The UK was recently reported to be considering stricter border controls for all travelers this week, while US President Joe Biden's administration said on Sunday that flights from South Africa would be banned. Meanwhile, France and other European countries are looking to tighten restrictions again, citing the emergence of the COVID-19 variable in the UK.

Investors are considering the ongoing risks surrounding the COVID-19 crisis, but on the other hand, the prospect of a robust coronavirus support package from the Biden administration is likely to boost sentiment. The administration will try this week to push for the $1.9 trillion stimulus to pass through Congress, but many commentators believe a smaller package will be agreed upon.

Nevertheless, the weak pound seen in the latter part of last week’s trading cannot be blamed solely on global markets. The pound retreated from its highest in nearly 3 years after bearish domestic data reinforced the case of lower interest rates in the UK. UK retail sales grew by 0.3% in December, which was well below the 1.2% that the markets had expected. Retail sales were then followed by the release of the most important PMI data, which arguably surprised the economic performance for January.

The numbers were not good, with the Service PMI reading at 38.8, which fell from 49.4 in December and well below expectations of 45.0, and hints at a sharp contraction in economic activity in the UK. However, markets are naturally looking forward and expecting the UK to achieve herd immunity through vaccinations ahead of the rest of Europe, and the US is likely to provide a locally inspired source of optimism about the currency.

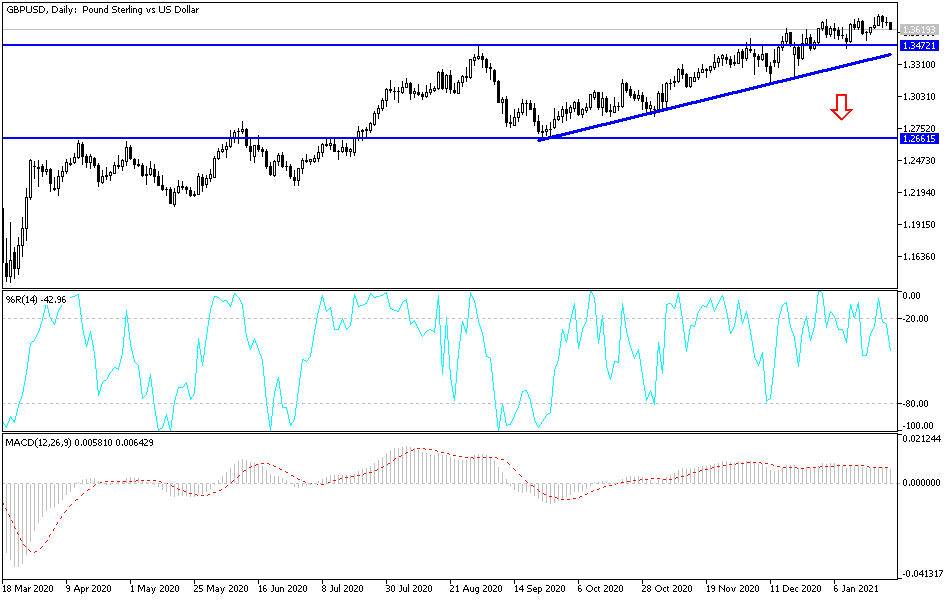

Technical analysis of the pair:

Despite the recent correction of the GBP/USD pair, the general trend remains bullish, and there will be no downward reversal without breaching the 1.3430 support level. A breakout to the 1.3700 resistance level would push technical indicators into strong overbought areas, thus leading to profit-taking sales, especially if the pound does not get more momentum.

Today, the currency pair will be affected by the performance of global stock markets, the announcement of Britain's jobs and wages numbers, and US consumer confidence.