Despite the USD's weakness and global coronavirus concerns, the GBP/USD pair is trying to resume its rise, stabilizing around the 1.3646 level. This came after a correction to the bottom that pushed the pair towards the support level at 1.3550, following the announcement of harsher lockdowns in Britain to contain the outbreak of the new COVID-19 strain. Focus has rapidly shifted from Brexit to the local economy in the United Kingdom, which has been burdened with the announcement of a complete closure in England, Scotland and Northern Ireland over the past 24 hours.

The impact of lockdowns on economic growth is expected to be negative, and the Bank of England could choose to cut interest rates once it meets on February 4 in an effort to provide additional support to the economy and the financial system. The bank’s interest rates have been set at just 0.10%, and the pound is expected to decline if market expectations of negative interest rates increase. Adam Cole, Senior Currency Analyst at RBC Capital, said: “First quarter GDP is still likely to be very negative as a result of the renewed lockdown measures that were just announced. We are bearish the British pound in the short and long term.”

British Prime Minister Boris Johnson announced a new lockdown as of Wednesday morning, asking people to stay home and ordering primary and secondary schools to close. School closures hampered a great deal of economic growth in March, when the first educational institutions closed. On the outlook for Bank of England policy, Analyst Kenneth Brooks at Societe Generale Investment Bank says, “Some members of the Bank of England's monetary policy committee were in favor of a rate cut in December and they are sure to become clearer if the economy is effectively shut down through another tight lockdown. COVID-19 and Brexit mean that growth in the UK will be disappointing, so if the data received does not lead to some profit-taking in sterling, the Bank of England may take the ECB's path. ”

The Bank of England has so far resisted taking interest rates into negative territory, choosing instead to wait for politicians to strike a trade deal after Brexit and for the COVID-19 pandemic to run its course while relying on quantitative easing to do most of the heavy lifting on the policy front.

The BoE said in 2020 that it expects the economy to return to normal by spring, but these assumptions can be tested through recent developments and market expectations of a negative interest rate cut by the bank sometime in 2021 as a result. Markets are expecting a fundamental rate cut of 0.10% by August. All in all, the resurgence of the epidemic and the subsequent economic restrictions weighed on the British pound.

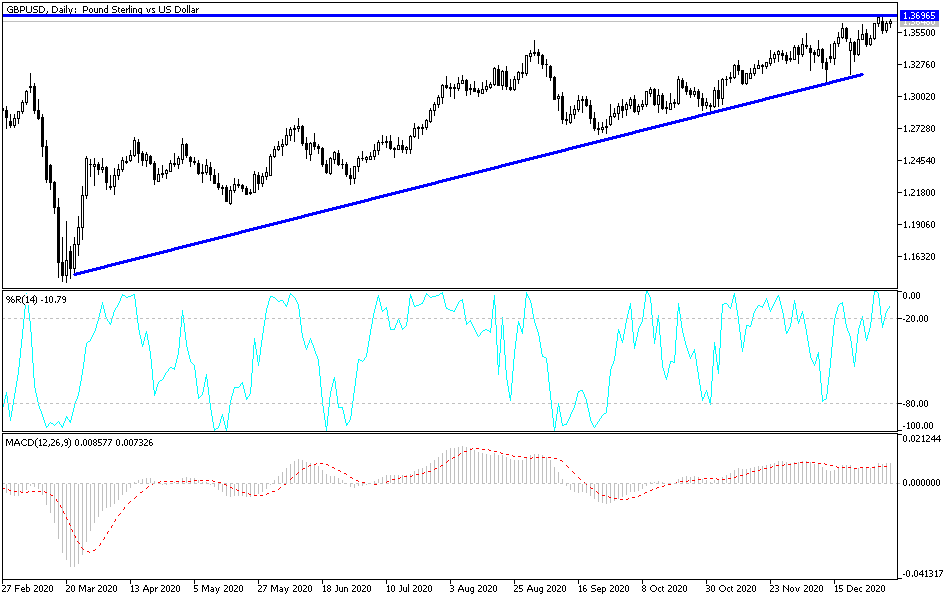

Technical analysis of the pair:

Despite the recent stalling of its gains, the GBP/USD pair is still within its ascending channel, benefiting from the weakness of the dollar and more risk appetite on the part of investors. However, the government's restrictions on the economy due to the pandemic are causing sell-offs in the pair again. The nearest bulls' targets are now 1.3660, 1.3725 and 1.3800, respectively. On the downside, there will be no reversal of the current trend without breaching the support level at 1.3490. Today, the currency pair is awaiting the announcement of the British Service PMI reading. In the United States of America, the ADP indicator reading will be announced to measure the change in the number of non-agricultural jobs, factory orders and oil inventories, and then the announcement of the minutes of the last meeting of the Federal Reserve Bank will be released.