The instability of the GBP/USD pair is a natural reaction to the new strains of COVID-19 spreading throughout Britain and the consequent economic restrictions. These restrictions, which weaken the British economy, will likely lead to more stimulus, and the Bank of England may adjust some of its monetary policies in line with recent pressures. Since the start of trading this first week of 2021, the pair has been in a range between the 1.3686 resistance level and the 1.3538 support level, and stabilized around the 1.3615 level at the beginning of Thursday's trading.

British Prime Minister Boris Johnson pledged that his government will use "every second available" to protect the elderly and the vulnerable from the virus that is spreading across Britain, as he told Parliament on Wednesday why the country needs to return to lockdowns. Accordingly, legislators were summoned from the Christmas holidays to discuss measures that came into effect at midnight. Despite some grumbling, they voted 524-16 to agree to a third national lockdown in England because there is broad consensus that tighter restrictions are needed to control the growing new infections.

Johnson said: “When the Office for National Statistics reported that more than 2% of the population is now infected, and when the number of hospital patients in England is now 40% higher than the first peak in April, the facts will inevitably change, we must change our response. We will use every available second of the closure to place this invisible shield around the elderly and the vulnerable."

Overall, Britain is in a cycle of increasing COVID-19 infections, hospitalizations and deaths. Britain reported more than 60,000 new confirmed cases within 24 hours for the second day in a row on Wednesday. In this regard, the authorities said that more than 403,914 people have tested positive for the virus in the past seven days, an increase of 43% over the previous week.

The rise in infections is also putting an unprecedented strain on the British healthcare system. Hospitals in the United Kingdom are treating 30,451 patients with the coronavirus, which is over 40% more than they were during the first peak of the epidemic in April. Authorities reported 1,041 deaths on Wednesday, the highest rate since April 21, and hospitals are overwhelmed with COVID-19 patients and medical workers, many of whom are exhausted after months of dealing with the virus.

Bank of England Governor Andrew Bailey told members of Parliament that it is reasonable to assume that the European Union and the United Kingdom can reach an agreement on financial services by the end of March. However, before the Treasury Select Committee in Parliament, Pelly said he did not expect any future financial services deal to achieve full parity.

Indeed, he seemed intent on rejecting the idea. “It's a very bad place if the UK becomes a rule-taker with the European Union on financial services,” he said.

Pelly's comments come as London-based firms lose the right to trade in euro-denominated assets, with Britain's exit from the European Union meaning that such firms must now be implemented within the European Union.

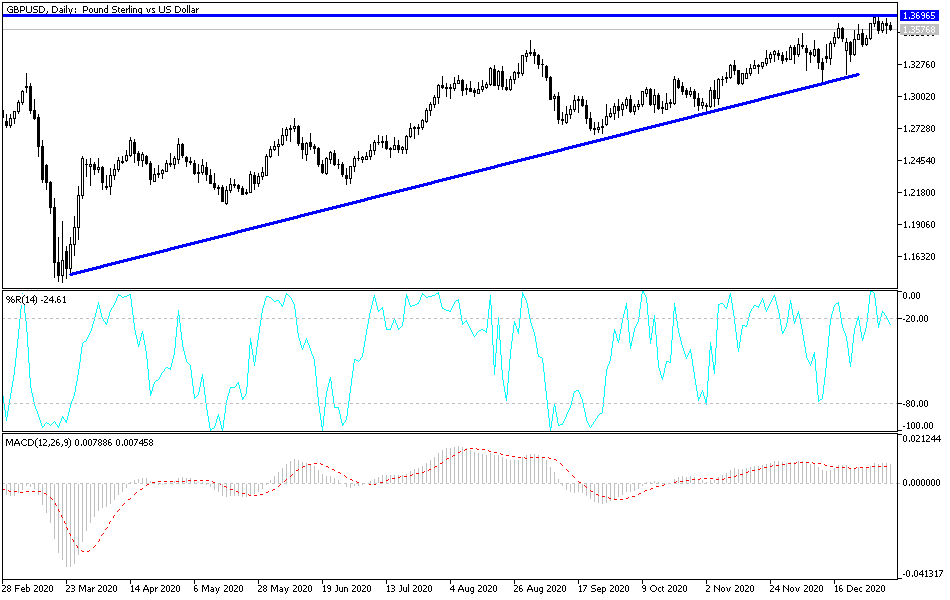

Technical analysis of the pair:

Despite the recent fluctuation of the GBP/USD pair, the general trend is still upward and stability above the resistance 1.3600 still supports strong bullish control. The pair's instability will continue as long as infections rise and the government implements restrictions. Any gains for the currency pair may be selling targets, as the US dollar is a preferred safe haven for investors in times of uncertainty. The closest strong resistance levels for the currency pair are currently 1.3660, 1.3720 and 1.3800. On the downside, a true bearish reversal will not occur without breaching the support level 1.3480, according to the performance on the chart below.

Today's economic calendar:

Regarding the GBP, the Construction PMI reading will be announced. Regarding the USD, the trade balance, unemployed claims and the ISM Service PMI will be announced.