Despite the recent strength of the US dollar, the GBP/USD pair rose to stabilize around the 1.3670 level as of this writing. In general, there is a fundamental shift in investor sentiment, as speculative interest in the British pound has turned positive again, with trading values set for the expected upward moves in the British pound now exceeding those for the bearish one. According to market position data from the Commodity Futures Trading Commission (CFTC), the net “buying” of the British pound - meaning the number of bets on the upside minus the number of bets on the downside - rose to a valuation of $1.1 billion last week.

Forex analysts interpret this development as an indication that the market is at a turning point in how it perceives the British pound, as the Forex trading community has been holding net bets on the currency depreciating for most of 2020. Jane Foley, Chief Forex Strategist at Rabobank, said : “The sterling net long positions rose to their highest level since March 2020 amid speculation that negative interest rates may not be used by the Bank of England, at least soon. The speculators may also feel comfortable with the poor trade agreement that was agreed between the European Union and the United Kingdom and through the introduction of the rapid vaccine in the United Kingdom."

“The British pound was bought for most of the past week by real and speculative investors such as hedge funds that are driving most of the recent developments,” says Valentin Marinov, Head of Foreign Exchange G10 strategy at Crédit Agricole. The analyst adds that long positions are now much higher than their medium-term average and the currency has entered overbought territory as a result. Aside from a trade deal between the European Union and the United Kingdom, other factors seem to be driving a renewed sentiment towards the British pound. A vaccination campaign under way in the United Kingdom places the country ahead of both the European Union and the United States in terms of vaccinations per 100 people, a development that could help the pound sterling in a world in which Forex investors reward those currencies that belong to countries emerging from the health crisis.

The United Kingdom has recorded more than 90,000 deaths related to the coronavirus, just ten days after it crossed the 80,000 threshold. Government figures show that another 1,610 people were reported to have died in 28 days after testing for COVID-19, bringing the total to 91,470. The daily increase is the highest daily number reported since the pandemic increased in the UK.

The numbers released on Tuesday have been steadily higher throughout the pandemic due to the effects of weekend delays. Although the number of people dying is rising every 7 days, the number of people who test positive for the virus is clearly declining in the wake of lockdown measures in place across the UK. Yesterday, the British government recorded 33,355 other people infected with the virus. This was the lowest since December 27.

The United Kingdom, the worst-hit country in Europe in terms of COVID-related deaths, recorded massive increases in cases at the turn of the year, as scientists blamed a new type of virus first identified around London and the southeast of England.

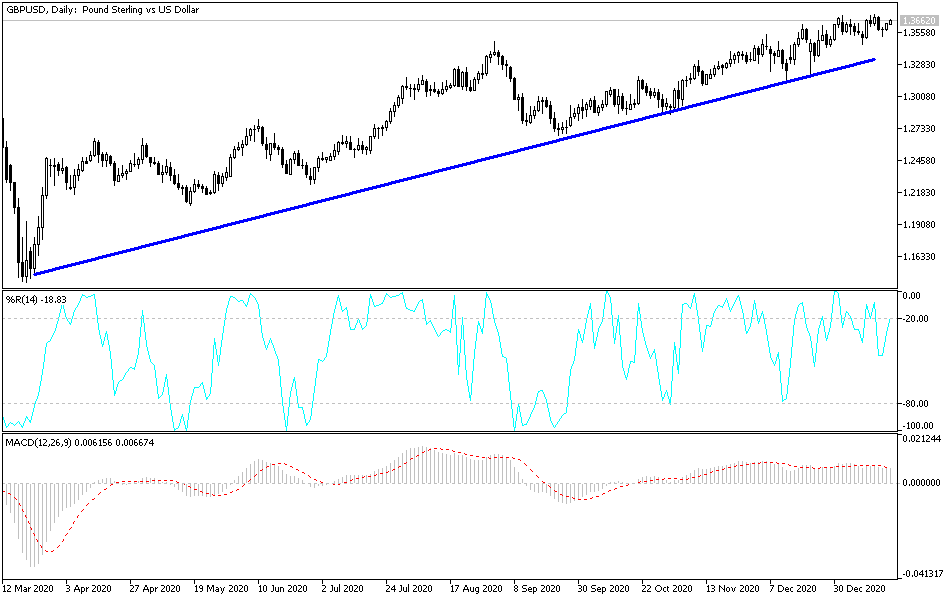

Technical analysis of the pair:

According to the performance on the daily chart, the GBP/USD pair is still moving within an upward channel, and breaching the resistance at 1.3700 will push it to move towards higher resistance levels, including the psychological resistance 1.4000. On the downside, there will be no real shift in direction without the currency pair moving below the support level of 1.3430, depending on performance over the same period of time.

Today's economic calendar:

For the GBP, inflation numbers will be announced, and there will be statements by the Governor of the Bank of England. For the USD, all the focus will be on the inauguration of Joe Biden.