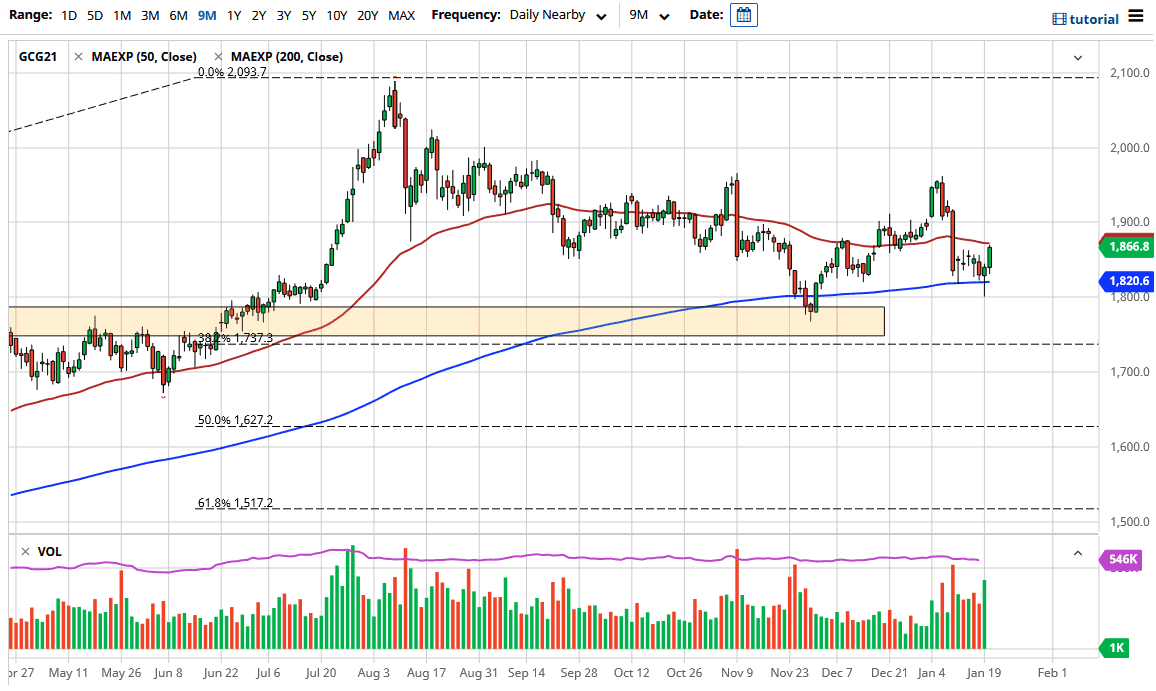

Gold markets have broken higher during the trading session on Wednesday, breaking towards the 50 day EMA. That of course is a large figure on the technical analysis background, but it should be noted that the market is essentially sideways. All things being equal, if we can break above the 50 day EMA then it opens up a possible move towards the $1900 level. I think at this point in time that probably is what happens next. This does not mean that we cannot pull back, and I think at this point time that would make quite a bit of sense. To the downside, I see the 200 day EMA sitting at the $1820 level, which has offered support previously as we formed a hammer at that level on Tuesday. Ultimately, I think this is a sign that we will continue.

Even if we do pull back at this point, I am more than willing to buy dips going forward as they can continue to see value hunters coming back time and time again as we have had more than enough reasons to believe that gold goes higher based upon massive stimulus coming out the United States, and of course the idea that other countries around the world will continue to flood the markets with ridiculous amounts of liquidity. As liquidity increases, people look for some type of hard asset that they can take advantage of.

The fact that we are closing towards the top of the candlestick also tells you that the market is very strong and should continue to be. At this point, it would take a significant breach of the $1800 level underneath for me to be concerned about the overall uptrend. Given enough time, I fully believe that this is a market that should continue to see a lot of people looking to get involved as we have been forming a larger basing pattern, and the action during the day on Wednesday only solidifies that thought process from what I can see. In fact, I fully believe that given enough time we will go looking towards the $2100 level again, which of course was the most recent high. This market will be very choppy, but at this point in time if you are cautious about your position size you will be able to ride out the volatility.