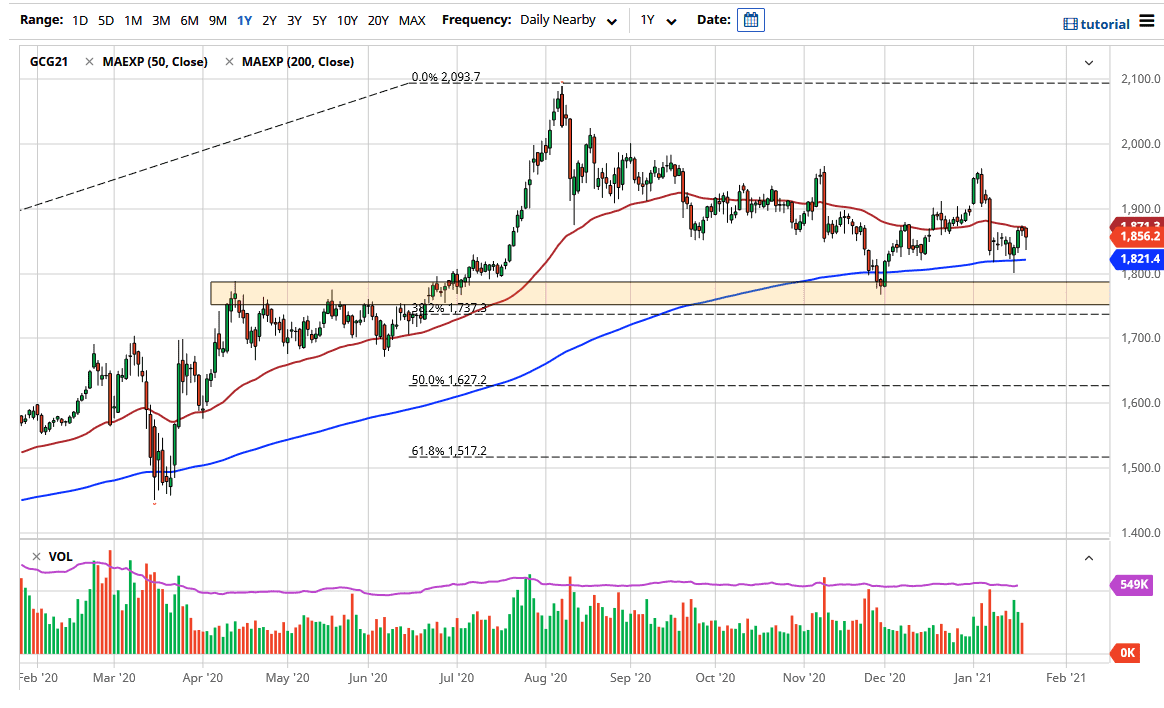

The gold markets fell during the trading session on Friday, reaching down towards the $1836 level. The market turning around the way it has shows that there is in fact quite a bit of support underneath, but it is probably in the middle of trying to build up some confidence and thus a larger basing pattern for gold.

A lot of what gold represents is whether or not we get some type of massive amount of stimulus. Stimulus drives down the value of the US dollar, and thereby should, by extension, send the price of gold higher. The top of the candlestick from Friday also coincides quite nicely with the 50-day EMA, so if we break above there, I think we will go looking towards the $1900 level, possibly even the $1960 level. The market breaking down below the bottom of the candlestick would be very negative for the short term, but I believe there are more than enough support levels underneath that should come into play as well. The $1800 level would be an area that is a large, round, psychologically significant figure and also where we have bounced from previously. I do believe that the area all the way down to the $1750 level could cause a certain amount of support. If we were to break down below there, then everything changes, perhaps sending gold much lower.

One of the things that you need to be paying the most attention to is the 10-year note in the United States. If those interest rates continue to rise over the longer term, meaning that that the market sells off, it is very likely that people will be more attracted to guaranteed interest instead of being bothered with gold. Higher interest rates wear upon the idea of gold without having a significant amount of inflation. The idea of the “reflation trade” is still out there, but more importantly, we have the central banks around the world doing everything they can to decimate their own currencies. That should continue to drive gold higher in multiple currencies, not just the US dollar. Short-term pullbacks continue to offer buying opportunities on short-term charts.