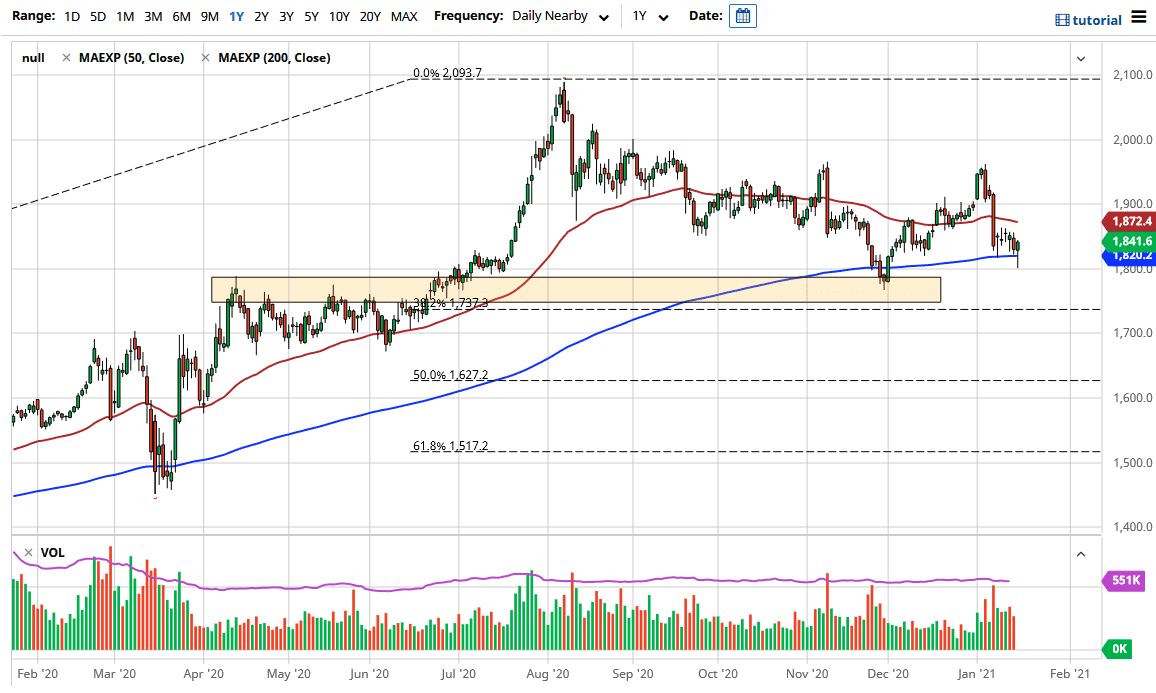

The gold market broke down significantly during the trading session on Tuesday to reach down towards the $1800 level. The $1800 level is a large, round, psychologically significant area that has been important more than once. That being the case, we have bounced from the $1800 level to form a nice-looking hammer, which is a very bullish sign. If we can break above the top of the hammer, then the market is likely to go looking towards the 50-day EMA, and then possibly even the $1900 level. A break above there could then send this market looking towards the $1960 level.

The market will continue to see a lot of buyers underneath due to the fact that we have been building a base in this general vicinity. The hammer itself is bullish, but at this point what we need to pay attention to is how the US dollar is doing. The US dollar can have a major influence, but the market will be very sensitive to the US Dollar Index. The biggest problem there is the fact that the US dollar has been oversold for a while, so it does make sense that we would see continued pressure.

I do think that, longer-term, we will go higher, and I believe that if we keep our leverage level, then we can get involved in the gold market. I do not have much in the way of desire to short this market, but if we broke down below the $1750 level, then I think the market could break down quite significantly. That would almost certainly have to see a major push higher in the US dollar, something that I just do not see happening more than a short-term move due to the fact that the Federal Reserve and the US Treasury are going to do everything they can to crush the greenback over the next year or two. Central banks around the world continue to flood the markets with liquidity, and as a result, gold will continue to rise against multiple currencies, not just the US dollar. At this point, the market looks as if it is simply trying to build some type of base.