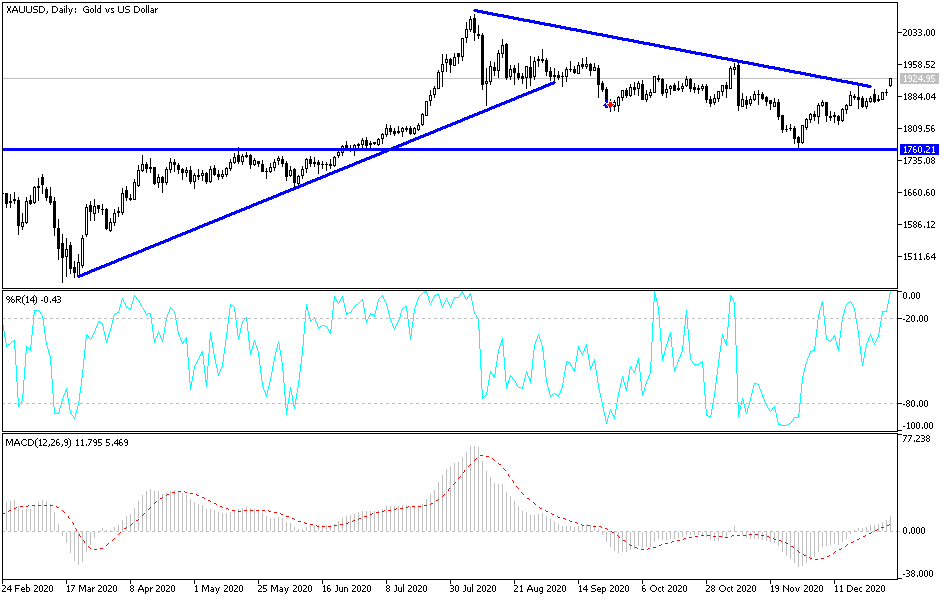

Gold markets rallied a bit during the trading session on New Year’s Eve, as the market is trying to break above a major trendline. We are sitting around the $1900 level, which is a large, round, psychologically significant figure. If we can break above there, the market is likely to go much higher, perhaps reaching towards the $1950 level. That is where we had sold off rather drastically previously, so I think we will target that area as soon as we break out. However, if we break above there it is likely that the market will go looking towards the $2000 level, and then possibly the $2100 level.

If we break down from here, then we could go looking towards the red 50-day EMA, which is at the $1873 level. Underneath there, the 200-day EMA is sitting at the $1813 level. That would be a significant support level as well, so it is not until we break down below there or perhaps even the $1800 level that I would be concerned about the overall trend. When you look at the pullback, we have only pulled back to the 30.2% Fibonacci retracement level, so it is only a matter of time before we go higher, as it typically means there is plenty of momentum.

I like the idea of gold going into 2021, because the US dollar is struggling. In fact, if you keep an eye on the US Dollar Index, you can see that the market is trying to break down and perhaps slice through the 88 handle. If it does, that will send gold much higher, as the US dollar will get absolutely eviscerated. We will continue to see a bit of choppiness, but we will eventually take off at this point, due to the fact that not only is the US dollar struggling, but fiat currencies in general will be shunned in favor of hard assets. Ironically, gold and Bitcoin are starting to serve the same purpose, although gold certainly has a lot of catching up to do at this point in time.