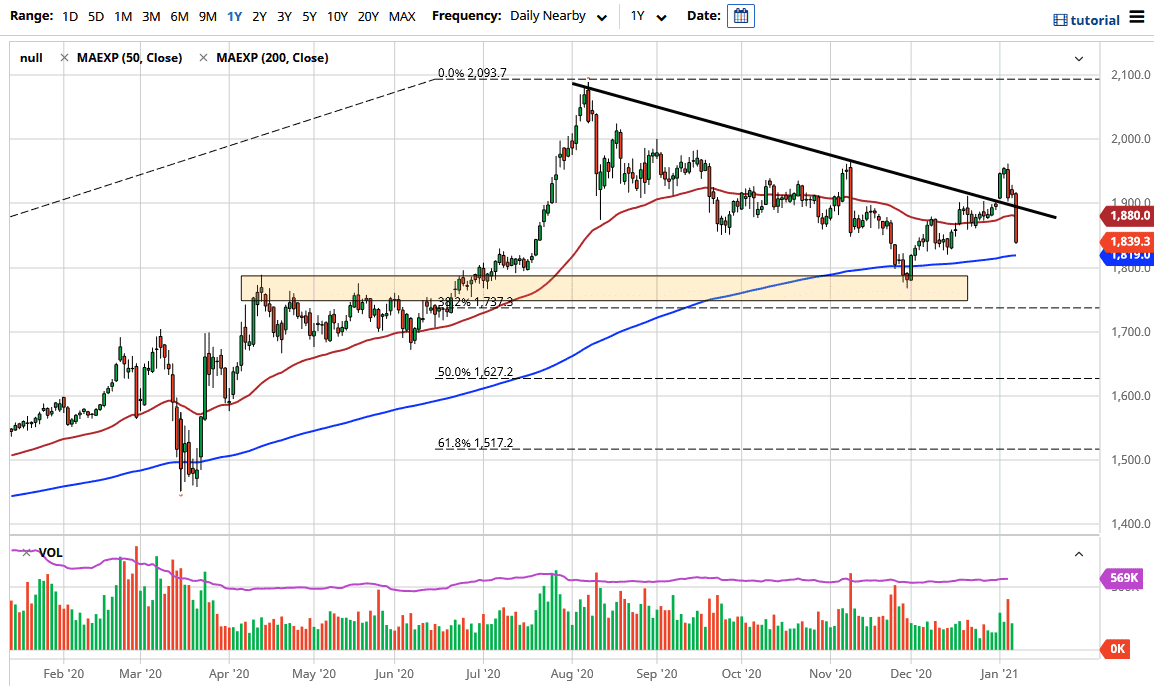

The gold markets broke down significantly during the course of the trading session on Friday, slicing through the 50-day EMA. The candlestick is a very long one and should continue to see a bit of bearish pressure. We are sitting just above the 200-day EMA, which is a long-term technical indicator that many will be watching. The selling off was due to a lot of interest rate gains in the 10-year, and it is likely that the market will see continued pressure on the precious metals markets. Longer term, I do think that the buying should continue, but it is a scenario in which we need to see some stability in the short term, perhaps for at least a few days in order to get involved.

On the other hand, if we can break down below the $1800 level, it is likely that the market will go much lower. We are going to test the $1800 level, but we need to be able to hang on to it in order to continue a bottoming pattern. Furthermore, you will need to pay attention to the 10-year rate in the United States, because if those yields continue to rise, it is very likely that we will see gold markets get absolutely crushed.

Pay attention to the US dollar as well, because it looks like it is starting to perk up just a bit. The market has a certain amount of an oversold attitude towards it, so the greenback probably needs to recover. If it does, that also works against the value of precious metals, so this is a market that I think will chop around. But if we see continued pressure in that bond market, that could cause major issues. I certainly would not be a buyer at this point in time, so I think the market will be best left alone. Yes, I do own gold at this point, but I only own little bits and pieces in order to build a longer-term bullish position. If we can wipe out the candlestick from the Friday session, that would be a very bullish sign.