Gold markets initially pulled back during the trading session on Tuesday, but then turned around to show signs of strength again. Now that we have cleared the $1950 level, it is likely that we will continue to go much higher given enough time.I do not necessarily think that we will get there overnight, and we could get the occasional pullback. Pullbacks should be thought of as potential buying opportunities, as we have so much stimulus coming out the United States.

With the Senate runoff election in Georgia overnight, we could see a sudden move into the gold markets due to the fact that the US dollar could get a bit serrated if the Democrats take control of the Senate. This is because there would be an expectation of massive stimulus coming out of America, which should bring down the value of the greenback. That does have a knock-on effect over here, as it is a strong inverted correlation.

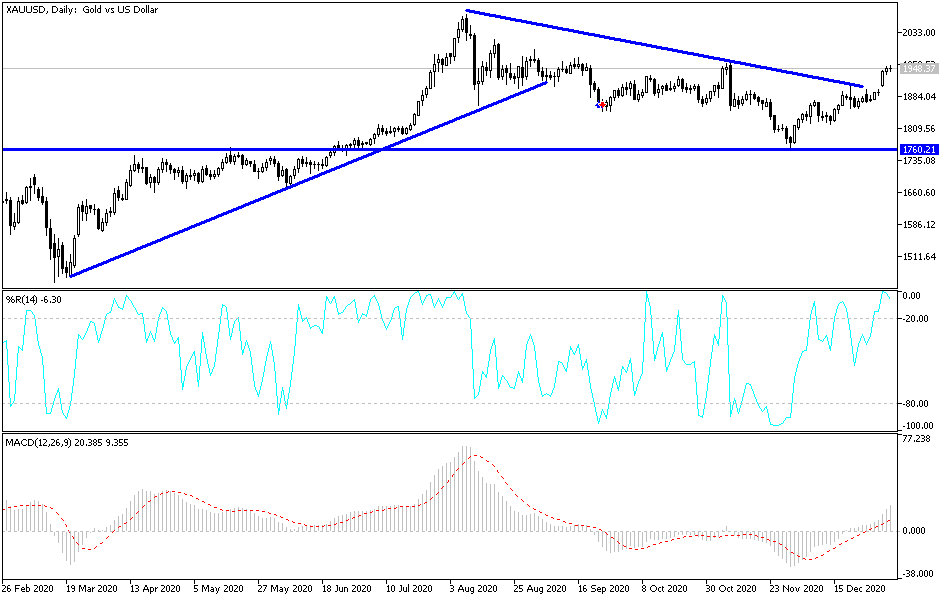

Nonetheless, the $1900 level underneath is an area that I think people will be interested in if we pull back, because it is a large, round, psychologically significant figure, and where we see a little bit of a gap. There is a downtrend line that slices through that area as well, so I think everything lines up quite nicely for any pullback to that area. The 50-day EMA reaching towards the $1900 level also could come into play. In other words, I do not have any interest whatsoever in shorting gold, and I think that we have just formed a longer-term basing pattern that is ready to take off to the upside.

To the upside, the $2000 level will be a target, possibly even a move towards the $2100 level. The value play will continue to be the best way going forward, as adding little bits and pieces along the way on dips makes the most sense. This is a market that obviously will have a lot of noise in it, but the writing is on the wall when it comes to the idea of US dollar devaluation, and it certainly looks as if gold markets are ready to go higher based upon what we have seen. Although the candlestick on Tuesday was a huge, the fact that we have continued is a good sign.