That being said, with stimulus in the United States continuing to work against the value of the greenback, it is very likely that we could see some type of bounce from here, if for no other reason than the fact that it is priced in US dollars.

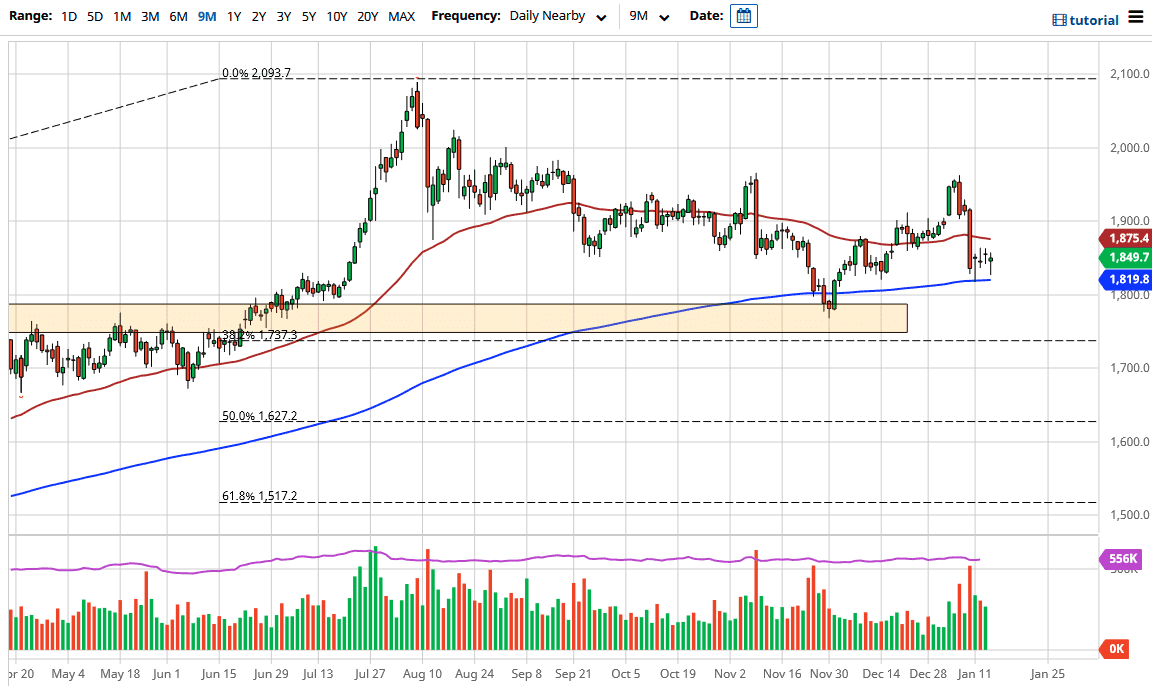

Just above, there is the 50 day EMA near the 1875 level, so that could cause a short-term resistance barrier but obviously if we break above the highs of the last couple of days, this is a market that could go looking towards the $1900 level above, possibly even as high as the $1960 level. This should continue to be what the market residue based upon the action that we have seen of the last four days, and the fact that even with the massive selloff that we had last week, we have not been able to continue that move.

If we were to break down below the 200 day EMA, the market could send gold down to the $1800 level, possibly even the $1750 level. It is not until we break down below the $1750 level that I would be concerned, but at that point I think you could even make an argument for shorting gold. I would pay close attention to the US Dollar Index, because of the dollar is suddenly strengthening, that could be one of the catalysts to send gold down to those levels. At this point though, it certainly seems to be favoring some type of bounce, and when you look at the longer charts, you can make out an argument for a basing pattern that we are still trying to kick off. I expect that the one thing you can probably count on is a lot of noisy and choppy trading, but that should not be a huge surprise considering how people just do not know what to do with risk appetite right now.