Gold markets have done very little during the trading session on Wednesday after initially gapping higher. This is bullish, considering what we had seen in the gold markets previously. Therefore, it makes sense to consider looking towards long positions in gold, because the US dollar has a long-term negative outlook, as the US government is certainly going to go on a massive spending spree. Beyond that, the Federal Reserve will almost certainly accommodate anything they can as far as asset prices, which should work against the value of the dollar long term.

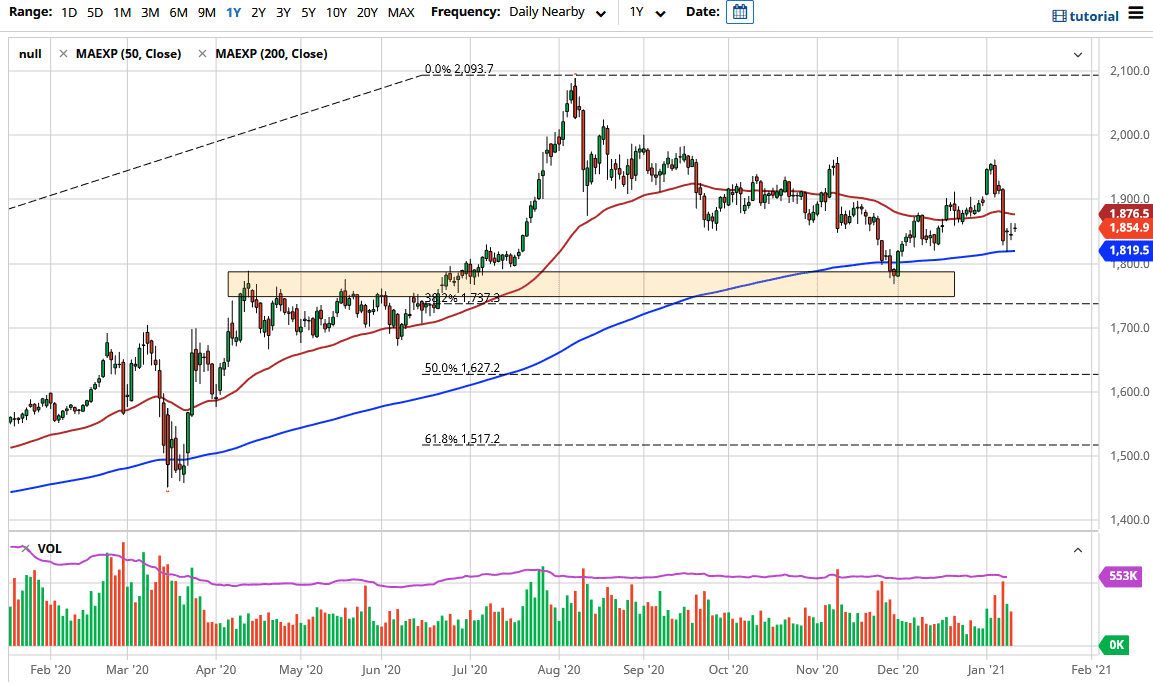

While there was a wicked sell-off last week, it is worth noting that we have essentially gone sideways over the last three days. Furthermore, we have bounced from the 200-day EMA, which is a long-term technical indicator that a lot of people watch. The market will find reasons to go higher eventually, if for no other reason than the devaluation of the greenback. Long term, I think that will continue to be a theme, but currently it seems as if we will continue to see a lot of demand for gold and other things to protect wealth.

There is a little bit of industrial demand for gold, but it is more about wealth preservation. The market is likely going to look towards the 50-day EMA in the short term, with the $1900 level being another target after that. If we can break above there, then the market will go looking towards the $1960 level next. Long term, I do think that we will go much higher, but in the short term there is a lot of noise that we have to work through. If you are more of an investor, this could be a good area in which to get involved, because one has to believe that sooner or later the rise in interest rates in the United States may cool off. I think gold will eventually find a reason to go higher regardless, and I have no interest in shorting anytime soon.